The Texas-based jeweler has also undergone a brand refresh, debuting a new website and logo.

Gold, silver prices to fall in 2014

The per-ounce price of gold and silver both will decline more than 10 percent year-over-year in 2014 while labor issues and automotive demand are expected to push up the price of platinum slightly, analysts say.

New York--The per-ounce price of gold and silver both will decline more than 10 percent year-over-year in 2014 while labor issues and automotive demand are expected to push up the price of platinum slightly, analysts say.

Last week, Market Watch published an analysis of gold price forecasts for 2014 from six banks: Bank of America Merrill Lynch, Barclays, Deutsche Bank, HSBC, J.P. Morgan and UBS.

The banks’ predictions for 2014 work out to an average per-ounce price of $1,209 for gold in 2014, down 15 percent from about $1,400 an ounce in 2013.

A similar consensus of nearly 30 analysts compiled by the London Bullion Market Association pegs gold at an average of $1,219 an ounce in the coming year, a 13 percent drop.

London-based analyst Andrew Leyland, the manager of precious metals demand at Thomson Reuters GFMS, said the price estimate for the next 11 months is very similar to what the actual price of gold is right now, which was $1,242 an ounce as of press time, according to Kitco.com.

“What the market is saying there is that the gold price is entering into a period of consolidation,” he said.

After dropping in 2013, gold prices are expected to stabilize this year because they are now being driven by physical demand instead of institutional investment, which tends to be a more volatile driver of price, he said.

Leyland said gold will hover around the $1,200 mark throughout 2014. He doesn’t see it rallying above $1,500 and, while it could dip below $1,000 an ounce briefly, it won’t stay there long, as jewelry demand will be enough to buoy it.

“Could the price dip below that ($1,200 an ounce)?” Leyland said. “We believe it can and it probably will but not for a sustained period of time.”

As reported in November, the per-ounce price of silver also will drop in 2014.

Leyland said Tuesday that Thomson Reuters GFMS predicts the price of silver will drop 20 percent in 2014 to $19 an ounce, driven by a decline in physical demand as more companies return to using gold.

The London Bullion Market Association’s forecast for silver in 2014 is $19.95 per ounce, down 19 percent from an average per-ounce price of $23.79 in 2013.

Leyland said when gold was $1,500 or $1,600 an ounce, many companies simply could not afford to use the metal and substituted silver.

While gold and silver prices are forecast to drop in 2014, platinum prices are expected to increase slightly, due to solid automotive demand worldwide and supply disruptions resulting from strikes in South Africa.

Thomson Reuters GFMS pegs the average annual price of platinum at $1,550 in 2014, a 4 percent year-over-year increase.

The consensus forecast from the London Bullion Market Association is slightly less bullish, at $1,490, up less than 1 percent from $1,487 last year.

Despite the slight increase in the platinum price, Leyland said the underlying tone for the jewelry industry in 2014--in gold, silver and platinum--is “relatively positive” due to improving economies around the globe.

The Latest

The two organizations have finalized and signed the affiliation agreement announced in May.

The single-owner sale will headline Sotheby's inaugural jewelry auction at the Breuer building, its new global headquarters, this December.

With their unmatched services and low fees, reDollar.com is challenging some big names in the online consignment world.

From sunrise yoga to tariffs talks, these are some events to check out at the upcoming inaugural event.

Smith recalls a bit of wisdom the industry leader, who died last week, shared at a diamond conference years ago.

The “Victoria” necklace features a labradorite hugged by diamond accents in 18-karat yellow gold.

Jewelers of America is leading the charge to protect the industry amidst rising economic threats.

Two lower courts have moved to block the import taxes, which will remain in place as the legal battle continues.

The Kansas City Chiefs quarterback shares Hublot’s dedication to pursuing greatness, the Swiss watchmaker said.

The Type IIa stone, recovered from Botswana’s Karowe diamond mine last month, features unique coloration.

Breitling is now the NFL’s official timepiece partner, a move that puts the brand in front of the millions of Americans who watch football.

NYCJAOS is set for Nov. 21-23 in New York City’s Chelsea neighborhood.

U.S.-based investment company SMG Capital LLC is the new owner of the luxury brand.

A new court filing details the locations of the stores that will close, as well as the 830 that will remain open.

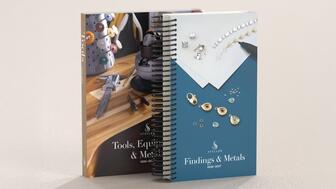

The new catalogs are “Tools, Equipment, & Metals” and “Findings & Metals.”

Sapphire’s variety of colors make it the perfect birthstone for September.

The retailer has raised its guidance after seeing total sales increase 3 percent in the second quarter, beating expectations.

Niccolò Rossi di Montelera, executive chairman of the board, was appointed as interim CEO.

The three-floor space also features the jeweler’s largest VIP salon in Japan and offers an exclusive diamond pendant.

The collection is a collaboration between Stephanie Gottlieb Fine Jewelry and Oak and Luna, focusing on understated essentials.

The highlight of a single-owner jewelry and watch collection, it’s estimated to fetch up to $7 million at auction this December.

CEO Efraim Grinberg noted a resurgence in the fashion watch market.

The “Bullseye” necklace, with vintage bakelite and peridot, August’s birthstone, is the perfect transitional piece as summer turns to fall.

Sponsored by Clientbook

It will classify lab-grown stones into one of two categories, “premium” or “standard,” in lieu of giving specific color and clarity grades.