The Italian jewelry company appointed Matteo Cuelli to the newly created role.

In 2019, Consumers Clicked On …

Editor-in-Chief Michelle Graff breaks down the data from GemFind’s annual report detailing activity on jewelry retail websites.

Oh, hello there.

It’s been a while since I’ve had the chance to write a blog post, as I’ve been busy working on a long-form story on lab-grown diamonds for our upcoming Market Issue, which is scheduled to come out in early May.

Last week, I finally had the chance to take a breath and catch up with GemFind CEO and President Alex Fetanat, whose company just released its annual Jewelry Consumer Trends Report.

The report distills data collected from the more than 400 retail jewelry websites that use the JewelCloud platform, breaking down what consumers clicked on and searched for most on retailers’ websites in 2019.

Overall, Fetanat said the total number of clicks increased year-over-year, highlighting the need for jewelers today to not only have a website, but to have a modern-looking one that displays the products they want to sell in their stores.

RELATED CONTENT: I’m Your Store’s Online Secret Shopper“[Jewelers] who don’t have a good online presence, or aren’t showing products online, they need to rethink that,” he said. “The data speaks for itself. People are searching, people are clicking on product.”

Here are five points of interest from the report, which can be found in its entirety on the GemFind website.

1. People click on diamonds all year long.

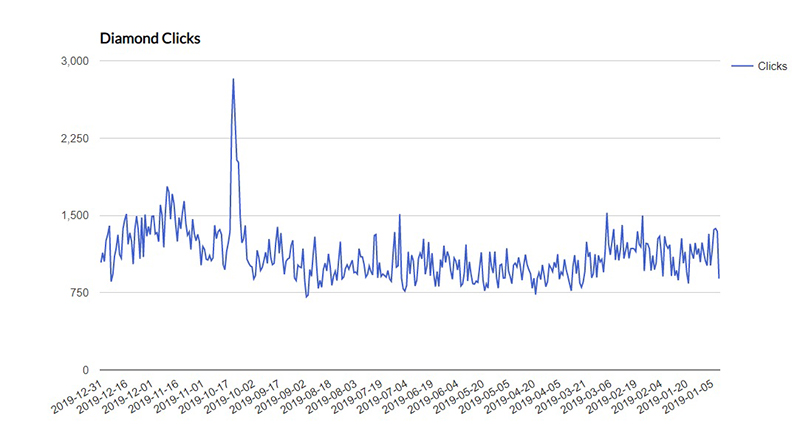

There are, however, a couple little peak periods in the clicks-by-month chart for 2019 GemFind produced (seen below).

We see a little spike in diamond clicks in early February (right before Valentine’s Day) and, interestingly, in early March.

A similar peak took place again in early July before searches spiked in mid-October (Fetanat said he does not have an explanation for this sharp increase, which happened around Oct. 17), and then remained elevated in November and December before falling off a bit later in the month.

These are, presumably, consumers searching for diamonds to pop the question over the holidays.

2. Consumers look for bridal jewelry more than anything else.

This isn’t surprising to anyone who knows the fine jewelry industry. Even with marriage rates down from what they were a couple decades ago, bridal is still a big business.

Millions of couples (2.2 million last year, according to The Wedding Report) still tie the knot every year, and as The Knot noted in its 2019 Jewelry & Engagement Study, 97 percent exchange a ring of some sort when they do so.

GemFind data shows in 2019, more

Searches for engagement ring semi-mounts predominated, accounting for nearly one-third (28 percent) of the total, while just “rings” accounted for 15 percent of searches and complete engagement rings, 13 percent.

Rounding out the list of most-searched-for jewelry items were necklaces (10 percent of searches), and earrings and watches (both 9 percent).

All told, 84 percent of jewelry searches were for one of the aforementioned items.

3. More than 40 percent of consumers clicked on items priced at $1,000 or less.

In 2019, the highest percentage of clicks, 32 percent, were concentrated in the $1,001-$2,500 price bracket, with GemFind calling this the “sweet spot” for diamond jewelry purchases.

But it’s worth noting 42 percent of clicks were on items priced at $1,000 or less: 16 percent of consumer clicks were on jewelry in the $501-$1,000 price range; 12 percent in the $251-500 range; 10 percent in the $101-250 range; and 4 percent clicks on items priced under $100.

Only 27 percent of clicks were concentrated on items priced at $2,501 and up, though it is interesting to note more consumers showed interest in items priced above $10,000 than $5,001-$7,500 or $7,501-$10,000.

4. White metals remain the overwhelming favorite.

While yellow gold fashion jewelry is enjoying a resurgence, and we even see a bit of yellow and rose gold popping up in bridal jewelry, consumers still search for white metals more than anything else.

The most-searched-for metal in 2019 was 14-karat white gold, which accounted for 41 percent of online looks, while 18-karat white gold came in at 11 percent, platinum held steady at 10 percent and sterling silver totaled 7 percent.

This brings the white metal total to 69 percent of all searches.

A total of 15 percent of consumers were looking for 14-karat yellow gold while about 5 percent searched 14-karat rose gold.

5. Consumers’ diamond desires remain the same.

The last time I did a story on GemFind’s consumer trends report was in September 2018. At that time, the overall profile of the diamond consumers looked for most was a 1-carat, G color diamond with VS2 clarity, excellent cut grade and a grading report from the Gemological Institute of America.

Fast-forward to 2019, and consumers are looking for a: G color, VS2 clarity diamond that is 1-1.25 carats with an excellent cut grade.

The most searched-for shape also remains unchanged.

It is far and away the round, with searches topping 160,000. The second-place shape, the oval, fell just short of 40,000 searches, while the cushion cut came in third place at about 35,000 searches.

And the Gemological Institute of America continued to dominate grading report searches; no other lab was even close.

GemFind data shows that in 2019, there were nearly 25,000 searches for GIA grading reports. The next two closest labs, International Gemological Institute (IGI) and European Gemological Institute (EGL), didn’t even hit 5,000.

The Latest

Sherry Smith unpacks independent retailers’ January performance and gives tips for navigating the slow-growth year ahead.

From how to get an invoice paid to getting merchandise returned, JVC’s Sara Yood answers some complex questions.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

Amethyst, the birthstone for February, is a gemstone to watch this year with its rich purple hue and affordable price point.

The manufacturer said the changes are designed to improve speed, reliability, innovation, and service.

President Trump said he has reached a trade deal with India, which, when made official, will bring relief to the country’s diamond industry.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The designer’s latest collection takes inspiration from her classic designs, reimagining the motifs in new forms.

The watchmaker moved its U.S. headquarters to a space it said fosters creativity and forward-thinking solutions in Jersey City, New Jersey.

The company also announced a new partnership with GemGuide and the pending launch of an education-focused membership program.

IGI is buying the colored gemstone grading laboratory through IGI USA, and AGL will continue to operate as its own brand.

The Texas jeweler said its team is “incredibly resilient” and thanked its community for showing support.

The medals feature a split-texture design highlighting the fact that the 2026 Olympics are taking place in two different cities.

From tech platforms to candy companies, here’s how some of the highest-ranking brands earned their spot on the list.

The “Khol” ring, our Piece of the Week, transforms the traditional Indian Khol drum into playful jewelry through hand-carved lapis.

The catalog includes more than 100 styles of stock, pre-printed, and custom tags and labels, as well as bar code technology products.

The chocolatier is bringing back its chocolate-inspired locket, offering sets of two to celebrate “perfect pairs.”

The top lot of the year was a 1930s Cartier tiara owned by Nancy, Viscountess Astor, which sold for $1.2 million in London last summer.

Any gemstones on Stuller.com that were sourced by an AGTA vendor member will now bear the association’s logo.

The Swiss watchmaker has brought its latest immersive boutique to Atlanta, a city it described as “an epicenter of music and storytelling.”

The new addition will feature finished jewelry created using “consciously sourced” gemstones.

In his new column, Smith advises playing to your successor's strengths and resisting the urge to become a backseat driver.

The index fell to its lowest level since May 2014 amid concerns about the present and the future.

The new store in Aspen, Colorado, takes inspiration from a stately library for its intimate yet elevated interior design.

The brands’ high jewelry collections performed especially well last year despite a challenging environment.

The collection marks the first time GemFair’s artisanal diamonds will be brought directly to consumers.