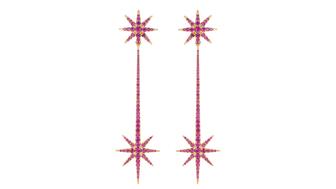

The new pink sapphire version of the piece dances with its wearer in the brand’s “Icons After Dark” holiday campaign.

On Data: A Closer Look at Loose Diamonds

Sherry Smith looks at sales and gross margins on loose diamonds in her latest deep-dive into industry data.

In this month’s column, we’re going to examine the performance of independent jewelers in the 12-month rolling period ended Jan. 30, and then dive into their performance in a category that’s become more challenging in recent years—loose diamonds.

Overall, jewelers showed an increase of 4.8 percent in gross sales year-over-year. This follows a strong January 2019, which had an 11 percent increase in gross sales.

Gross profit dollars were also up, climbing 4.8 percent.

The number of units sold slipped 5 percent, while gross margin held steady at 46.1 percent and the average retail sale grew 10 percent, from $304 to $335.

Meanwhile, loose diamonds showed a 2.1 percent increase in gross sales, a 2 percent increase in gross profit dollars and a 4.9 percent increase in average retail sale in the 12-month rolling period.

Of the $2 billion in total aggregated sales data from the independent channel collected by The Edge Retail Academy, the loose diamond category represents 13 percent of total revenues and 10 percent of total annual gross profit dollars.

This makes loose diamonds the single most important category for independents.

I’ve saved the best on loose diamonds for last—the gross margin. This is such a hot topic and, no doubt, I am opening Pandora’s box by mentioning it.

I must admit, it is very interesting to see retailers’ and vendors’ reactions to the actual gross margin being achieved.

Vendors tend to be surprised by how low the actual gross margin is, while retailers are surprised that retailers are getting that high of a margin. It’s all about perspective.

Let’s break down loose diamond gross margin by region: Midwest – 38.8 percent; Northeast – 32.7 percent; South – 37 percent; Southeast – 35.9 percent; and the West – 38 percent.

It’s not surprising to see the Midwest with the highest gross margin, given that the region tends to be more rural, just as it’s not a shock to see the Northeast, where it’s more densely populated and there is more competition, with the lowest.

Nonetheless, there are lots of contributing factors to the gross margin of loose diamonds: attempting to match online pricing, selling loose as a commodity, removing the emotional part of the purchase, the entry of lab-grown diamonds into the market in larger quantities, etc.

After all, the purchase of a loose diamonds is, in most cases, made to mark a momentous occasion in customers’ lives that should be celebrated.

The Latest

A choice that’s generated a lot of commentary, Pantone says “Cloud Dancer” marks a fresh start and encourages relaxation and creativity.

The manufacturer’s holiday campaign features a gift guide filled with trending designs and jewelry that can be personalized.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

The man was charged with theft, accused of ingesting the necklace while in a jewelry store in Auckland, New Zealand.

The Florida independent expanded its store from 8,000 to 14,000 square feet, fulfilling the vision of its late co-founder, Jim Dunn.

Sponsored by De Beers Group

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The classic 5600 series G-Shock has been scaled down to about a tenth of its size, becoming a fully functioning watch ring.

The association’s annual conference and gala will take place Feb. 4, 2026, during the Tucson gem shows.

The January show will include a workshop for jewelry retailers on implementing AI to strengthen their businesses.

Fellow musician Maxx Morando proposed to the star with a chunky, cushion-cut diamond ring designed by Jacquie Aiche.

The retailer, which sells billions in fine jewelry and watches, is suing the Trump administration and U.S. Customs and Border Patrol.

Black Friday is still the most popular shopping day over the five-day holiday weekend, as per the National Retail Federation’s survey.

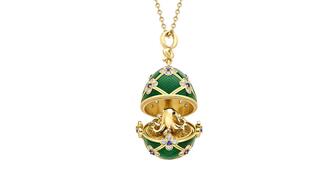

The historic egg, crafted for Russia's ruling family prior to the revolution, was the star of Christie’s recent auction of works by Fabergé.

The retailer offered more fashion jewelry priced under $1,000, including lab-grown diamond and men’s jewelry.

The eau de parfum is held in a fluted glass bottle that mirrors the decor of the brand’s atelier, and its cap is a nod to its “Sloan” ring.

Vivek Gadodia and Juan Kemp, who’ve been serving as interim co-CEOs since February, will continue to lead the diamond mining company.

In addition, a slate of new officers and trustees were appointed to the board.

Witt’s Jewelry in Wayne, Nebraska, is the organization’s new milestone member.

Laurs is the editor-in-chief of Gem-A’s The Journal of Gemmology and an expert on the formation of colored gemstone deposits.

The man, who has a criminal history, is suspected of being the fourth member of the four-man crew that carried out the heist.

The single-owner collection includes one of the largest offerings of Verdura jewels ever to appear at auction, said Christie’s.

Michael Helfer has taken the reins, bringing together two historic Chicago jewelry names.

The guide features all-new platinum designs for the holiday season by brands like Harwell Godfrey, Ritani, and Suna.

During its Q3 call, CEO Efraim Grinberg discussed the deal to lower tariffs on Swiss-made watches, watch market trends, and more.

Rosior’s high jewelry cocktail ring with orange sapphires and green diamonds is the perfect Thanksgiving accessory.