A double-digit drop in the number of in-store crimes was offset by a jump in off-premises attacks, JSA’s 2023 crime report shows.

Signet to Acquire JamesAllen.com Owner for $328M

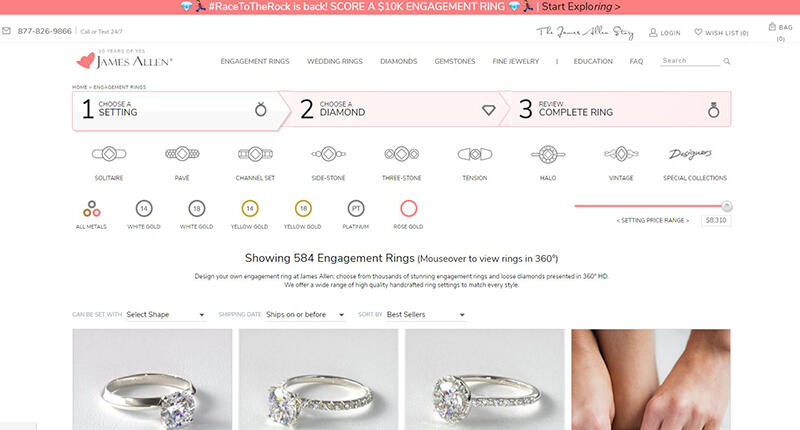

The jeweler said it will operate JamesAllen.com as an independent division while also adding parent company R2Net’s technology to its own stores’ websites.

New York--Signet Jewelers Ltd. has acquired R2Net, the owner of online retailer JamesAllen.com, for $328 million in cash, the retailer announced Thursday morning.

The acquisition allows Signet to add what new CEO Gina Drosos described as a “very strong, fast-growing e-commerce brand” to its portfolio and gives the retailer control of R2Net’s technology arm, Segoma Imaging Technologies, which Drosos said will enable it to “deliver a new-generation digital shopping strategy for jewelry.”

These technologies include a diamond imaging camera, which can create 360-degree HD images with a 40x super-zoom and can be used on any device; 3-D imaging technology that allows shoppers to pair loose diamonds with rings; a ring try-on app; and 24/7 customer service and chat capabilities.

Signet will be bringing the JamesAllen.com executive team on board, including co-founder and CEO Oded Edelman, who will become Signet’s chief digital innovation adviser, reporting directly to Drosos.

Drosos said for now, the plan is to operate JamesAllen.com as an independent division of Signet, while also applying R2Net’s technologies to their stores’ websites and using it in stores. Over time, the retailer will look at whether a showroom-type concept makes sense for JamesAllen.com.

Signet took out a short-term loan to pay for the acquisition, which it will repay with proceeds from the sale of its prime-only credit accounts under its credit outsourcing program.

The transaction is expected to close in the third quarter and is subject to customary closing conditions and regulatory approval.

The announcement came as Signet released its results for the second quarter ended July 29, the first call it has held since Mark Light stepped down and Drosos became CEO at the end of July.

Same-store sales were up 1 percent, driven by e-commerce platform improvements--online sales were up 18 percent in the quarter--Mother’s Day, which is typically split between Q1 and Q2 but fell squarely in Q2 this year, and a July bridal event.

This included a 7 percent increase in same-store sales at Piercing Pagoda and 3 percent at Kay Jewelers. Comps were essentially flat for both Jared the Galleria of Jewelry and Zales in the quarter.

Signet’s total sales were $1.40 billion, a 2 percent year-over-year increase.

Operating income was $135.6 million, or 9.7 percent of sales, compared with $119.9 million, or 8.7 percent of sales, in the prior-year period.

So far this year, Signet has closed 98 stores, mostly regional brands and underperforming mall stores, and opened 53, for a net loss of 45 stores.

On

Signet said that part one of the plan, the sale of $1 billion of prime-only credit accounts, is on track for completion in October. The retailer also said that its lease-purchase program has been rolled out ahead of schedule.

The Latest

Inspired by the Roman goddess of love, the designer looked to the sea for her new collection.

The selected nine organizations have outlined their plans for the funds.

With Ho Brothers, you can unlock your brand's true potential and offer customers the personalized jewelry experiences they desire.

The mining company’s Diavik Diamond Mine lost four employees in a plane crash in January.

The crown introduced a dozen timepieces in Geneva, including a heavy metal version of its deep-sea divers’ watch.

Emmanuel Raheb recommends digging into demographic data, customizing your store’s communications, and retargeting ahead of May 12.

For over 30 years, JA has advocated for the industry, fought against harmful legislation and backed measures that help jewelry businesses.

Located in the town of Queensbury, it features a dedicated bridal section and a Gabriel & Co. store-in-store.

A 203-carat diamond from the alluvial mine in Angola achieved the highest price.

Ruser was known for his figural jewelry with freshwater pearls and for his celebrity clientele.

The “Rebel Heart” campaign embodies rebellion, romance, and sensuality, the brand said.

Editor-in-Chief Michelle Graff shares the standout moments from the education sessions she attended in Austin last week.

The overhaul includes a new logo and enhanced digital marketplace.

The money will go toward supporting ongoing research and aftercare programs for childhood cancer survivors.

A new addition to the “Heirloom” collection, this one-of-a-kind piece features 32 custom-cut gemstones.

Last month in Dallas, David Walton pushed another jeweler, David Ettinger, who later died.

The move will allow the manufacturing company to offer a more “diverse and comprehensive” range of products.

From now through mid-May, GIA will be offering the reports at a 50 percent discount.

De Beers’ rough diamond sales were down 18 percent year-over-year in its latest round of sales.

Sponsored by the Las Vegas Antique Jewelry & Watch Show

The Patek Philippe expert will serve as personal curator for the brand-focused company.

The 553-square-foot shop is aboard the Carnival Jubilee cruise ship.

NDC filed a complaint against Skydiamond for use of phrases like “diamonds made entirely from the sky.”

John Carter received the AGS’s highest honor Tuesday afternoon at Conclave in Austin, Texas.

B&D Sales and Service held a ribbon-cutting event for its new location in Cranston, Rhode Island.

It’s ultra-feminine and filled with gold, pearls, and soft pastels.