From tech platforms to candy companies, here’s how some of the highest-ranking brands earned their spot on the list.

Signet Reaches $240M Settlement in Shareholder Lawsuit

The company denies the allegations, but said it reached a settlement to avoid spending more time and resources on the case.

New York—Signet reached a $240 million settlement last week in a shareholder lawsuit accusing it of misleading investors about sexual harassment allegations and the health of its credit portfolio, court documents show.

In a statement emailed to National Jeweler, Signet Jewelers Ltd. said while it believes the case is without merit, it made the strategic decision to enter a settlement to eliminate “risks, ongoing resource needs, and the distraction” of litigation.

“Consistent with our core values, we take all of our legal disclosure obligations seriously, and we have rigorous policies and practices to ensure we make required disclosures,” the company said.

Court documents show Signet denied any liability with respect to the allegations and refuted the claim that the price of its common stock was “artificially inflated by reason of any alleged misrepresentations, omissions, or otherwise.”

Signet described the settlement as a “positive step” for the company as it looks to focus its time and resources on its turnaround plan, called the “Path to Brilliance.”

The proposed securities class action against Signet was originally filed in 2016 by The Public Employees’ Retirement System of Mississippi, a pension fund and the lead plaintiff in the case.

The lawsuit includes all persons or entities that acquired Signet common stock between Aug. 29, 2013 and May 25, 2017.

The sexual harassment aspect of the shareholder lawsuit relates to Jock, et al. v. Sterling Jewelers Inc., a subsidiary of Signet.

That case was filed in March 2008 by a group of women who accused the company of paying them less than their male colleagues and passing them over for promotions because they are women.

While the Jock case does not include sexual harassment allegations, documents connected to the case were eventually unsealed and reported on by The Washington Post and other media outlets.

The reports painted a picture of a culture where women were objectified, disrespected and scared to report what was happening out of fear of retaliation.

The negative publicity sent Signet’s stock price plummeting, a point noted in the shareholder lawsuit.

In regard to its credit portfolio, which has since been outsourced, the suit claims Signet hid losses on high-risk subprime loans that once made up 45 percent of its $1.7 billion customer loan portfolio.

Of the $240 million settlement, $205 million is expected to be paid by insurance with the company paying the remaining $35 million, Signet said in a 10-K filing.

The settlement is subject to the approval

Signet previously sought to have the entire shareholder lawsuit dismissed, but McMahon denied that motion in November 2018.

The following June, the judge denied another motion by Signet to dismiss the sexual harassment aspect brought up in the shareholder lawsuit.

In short, the company claimed its code of ethics, which included statements about staying in compliance with the law and acting with integrity, were general statements and not something a reasonable investor would take into consideration when buying shares of the company.

McMahon disagreed with that statement, noting several examples of how Signet sought to reassure its investors that it did not operate a toxic workplace, including a denial of allegations in its SEC filings.

“As alleged, a reasonable investor—who otherwise would be concerned about how grave allegations concerning rampant sexual misconduct might affect her investment in Signet—took defendants at their word,” the judge wrote.

“As alleged, their word was not truthful.”

Attorney Kevin M. LaCroix, who was not involved in the case but wrote a blog post about the settlement, noted the settlement amount is significant, ranking 71st on the list of Top 100 Securities Class Action Settlements compiled by the ISS Securities Class Action Services.

He said to his knowledge, the Signet Jewelers settlement is also the first settlement in a #MeToo-related (sexual harassment-related) securities suit, though he noted the Signet case is more complicated than other #MeToo-related management liability lawsuit settlements, like the cases against 21st Century Fox and Wynn Resorts, because it prominently features allegations unrelated to sexual harassment.

“It is hard to know how much of the $240 million settlement of the Signet Jewelers securities suit is related to the underlying sexual harassment allegations,” LaCroix wrote in his blog post. “Clearly, some indeterminate but not-insignificant portion of the settlement is not related to the #MeToo allegations.”

The Latest

The “Khol” ring, our Piece of the Week, transforms the traditional Indian Khol drum into playful jewelry through hand-carved lapis.

The catalog includes more than 100 styles of stock, pre-printed, and custom tags and labels, as well as bar code technology products.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

The chocolatier is bringing back its chocolate-inspired locket, offering sets of two to celebrate “perfect pairs.”

The top lot of the year was a 1930s Cartier tiara owned by Nancy, Viscountess Astor, which sold for $1.2 million in London last summer.

Any gemstones on Stuller.com that were sourced by an AGTA vendor member will now bear the association’s logo.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The Swiss watchmaker has brought its latest immersive boutique to Atlanta, a city it described as “an epicenter of music and storytelling.”

The new addition will feature finished jewelry created using “consciously sourced” gemstones.

In his new column, Smith advises playing to your successor's strengths and resisting the urge to become a backseat driver.

The index fell to its lowest level since May 2014 amid concerns about the present and the future.

The new store in Aspen, Colorado, takes inspiration from a stately library for its intimate yet elevated interior design.

The collection marks the first time GemFair’s artisanal diamonds will be brought directly to consumers.

The initial charts are for blue, teal, and green material, each grouped into three charts categorized as good, fine, and extra fine.

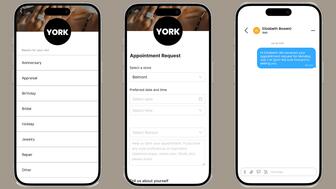

The new tool can assign the appropriate associate based on the client or appointment type and automate personalized text message follow-ups.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Endiama and Sodiam will contribute money to the marketing of natural diamonds as new members of the Natural Diamond Council.

The retailer operates more than 450 boutiques across 45 states, according to its website.

The new members’ skills span communications, business development, advocacy, and industry leadership.

The jeweler’s 2026 Valentine’s Day campaign, “Celebrating Love Stories Since 1837,” includes a short firm starring actress Adria Arjona.

The new features include interactive flashcards and scenario-based roleplay with AI tools.

Family-owned jewelry and watch retailer Deutsch & Deutsch has stores in El Paso, Laredo, McAllen, and Victoria.

The Italian luxury company purchased the nearly 200-year-old Swiss watch brand from Richemont.

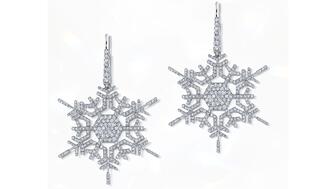

Micro-set with hundreds of diamonds, these snowflake earrings recreate “winter’s most elegant silhouette,” and are our Piece of the Week.

Ella Blum was appointed to the newly created role.

Sponsored by RapNet