The chocolatier is bringing back its chocolate-inspired locket, offering sets of two to celebrate “perfect pairs.”

Samuels Jewelers Files for Bankruptcy

It is the fourth U.S.-based company impacted by the multibillion-dollar bank fraud scandal that erupted in India earlier this year.

Wilmington, Del.—Samuels Jewelers Inc., the Texas-based jewelry chain controlled by Mehul Choksi, has filed for Chapter 11 bankruptcy.

The filing for the 120-store chain comes in the wake of a $1.8 billion bank fraud allegedly perpetrated by Choksi, who is the owner of Samuels parent company Gitanjali Gems, and his nephew, Nirav Modi, both of whom are wanted by Indian authorities.

According to an affidavit filed in U.S. Bankruptcy Court in Delaware on Tuesday, the bank scandal Choksi is implicated in “amplified the headwinds” already pounding Samuels Jewelers.

The retailer has seen sales slide and profits shrink in recent years due to competition from discount and online retailers.

When news of the scandal broke, Samuels Jewelers lost a major source of its products and funding in Gitanjali (which, according to court papers, has not been in operation since February), and vendors began to pull out, refusing to supply the retailer with merchandise on consignment.

According to court papers, the retailer is looking to sell itself as a going concern, but, in the meantime, plans to close more than 100 stores and has brought in Gordon Brothers Retail Partners and Hilco Merchant Resources to start selling off inventory in order to begin paying off its debts, which total more than $100 million and include millions owed to Wells Fargo N.A. and GB Credit Partners LLC.

The company also owes millions to vendors and service providers.

Court papers show that Samuels Jewelers’ five largest unsecured creditors are: Exclusive Design Direct Inc., a Sterling Heights, Michigan-based collection agency (owed $9.1 million); Taipinyang Trading Ltd., a Hong Kong company (owed $6.1 million); New York-based lab-grown diamond company GoGreen Diamonds Inc. (owed $5.5 million); New York-based Jewel Evolution Inc. ($2.4 million); and Austin, Texas-based jewelry company Voyager Brands Inc. (owed $973,952).

Samuels Jewelers joins A. Jaffe, Firestar Diamond and Fantasy Inc., which were owned by Nirav Modi, in filing for bankruptcy in the wake of the Indian bank scandal.

A. Jaffe has since has been sold as a going concern, and companies have purchased inventory held by both Fantasy and Firestar.

Tuesday’s filing marks the fourth trip through bankruptcy court for the chain that today is known as Samuels Jewelers, employs 690 people and has stores in 23 states operating under five nameplates: Samuels Jewelers, Rogers Jewelers, Andrews Jewelers, Schubach Jewelers and Samuels Diamonds.

David Blum and Gerson Fox founded the specialty jeweler

According to court papers, in the mid-1980s, the chain took advantage of lenient credit standards, increased consumer spending and the rapid expansion of indoor shopping malls to open more stores and acquire Mission Jewelers from Zale Corp. and Samuels Jewelers from Peoples Jewelers.

In the early 1990s, after almost a decade of growth and acquisitions, the company began to experience “financial distress.” It filed for Chapter 11 bankruptcy in February 1992.

It emerged from bankruptcy but was struggling again toward the end of the ‘90s, filing for Chapter 11 for the second time in May 1997.

When it emerged this time, 36 percent of the company was owned by DDJ Capital Management, and its board decided to change the company’s name from Barry’s Jewelers to Samuels Jewelers, its “most successful and, to the consumer, easily recognizable division,” court papers state. They also moved the company headquarters from California to Austin.

The retailer filed Chapter 11 for the third time in August 2003, and Gitanjali Gems bought the retailer shortly thereafter, in December 2006. It later acquired Rogers Ltd. and added Rogers Jewelers and Andrews Jewelers to its stable of U.S. retailers.

Gitanjali merged the two companies in 2010.

The Latest

The top lot of the year was a 1930s Cartier tiara owned by Nancy, Viscountess Astor, which sold for $1.2 million in London last summer.

Any gemstones on Stuller.com that were sourced by an AGTA vendor member will now bear the association’s logo.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

The Swiss watchmaker has brought its latest immersive boutique to Atlanta, a city it described as “an epicenter of music and storytelling.”

The new addition will feature finished jewelry created using “consciously sourced” gemstones.

In his new column, Smith advises playing to your successor's strengths and resisting the urge to become a backseat driver.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The index fell to its lowest level since May 2014 amid concerns about the present and the future.

The new store in Aspen, Colorado, takes inspiration from a stately library for its intimate yet elevated interior design.

The brands’ high jewelry collections performed especially well last year despite a challenging environment.

The collection marks the first time GemFair’s artisanal diamonds will be brought directly to consumers.

The initial charts are for blue, teal, and green material, each grouped into three charts categorized as good, fine, and extra fine.

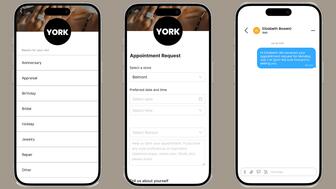

The new tool can assign the appropriate associate based on the client or appointment type and automate personalized text message follow-ups.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Endiama and Sodiam will contribute money to the marketing of natural diamonds as new members of the Natural Diamond Council.

The jeweler’s 2026 Valentine’s Day campaign, “Celebrating Love Stories Since 1837,” includes a short firm starring actress Adria Arjona.

The new features include interactive flashcards and scenario-based roleplay with AI tools.

Family-owned jewelry and watch retailer Deutsch & Deutsch has stores in El Paso, Laredo, McAllen, and Victoria.

The Italian luxury company purchased the nearly 200-year-old Swiss watch brand from Richemont.

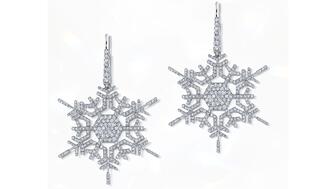

Micro-set with hundreds of diamonds, these snowflake earrings recreate “winter’s most elegant silhouette,” and are our Piece of the Week.

Ella Blum was appointed to the newly created role.

Sponsored by RapNet

Investment firm Enhanced Retail Funding, a division of Gordon Brothers, was the successful bidder.

It explores the history of the iconic tagline and the company’s strategy to redefine the role of diamonds in society.

Retail veteran Sindhu Culas has stepped into the role.

Taylor Burgess, who has been at Stuller since 2013, was promoted to the newly created role.