De Beers’ rough diamond sales were down 18 percent year-over-year in its latest round of sales.

Forever 21 Reaches $81M Deal to Sell the Business

Mall owners Simon Property Group and Brookfield Property Partners and licensing company Authentic Brands Group want to buy the bankrupt fast-fashion retailer.

Los Angeles—Forever 21 has found a buyer.

The fast fashion retailer reached an $81 million deal to sell its retail business to Authentic Brands Group and mall owners Simon Property Group and Brookfield Property Partners, as per court documents filed Sunday.

Forever 21 filed for Chapter 11 bankruptcy protection in Sept., announcing plans to close stores in the U.S. and internationally.

In a statement, Forever 21 said of the sale: “Once approved the agreement will allow Forever 21 to come out of bankruptcy, keeping its headquarters, stores and ecommerce operations open, providing fashions and trends that customers know and love for years to come.”

The Los Angeles-based company’s first international store opened in Canada in 2001.

By 2015, the company had 251 international stores, expanding to 40 countries across five continents.

In a court statement last fall, Chief Restructuring Officer Jonathan Goulding pointed to the company’s swift growth as a factor in its bankruptcy.

“Unfortunately, this rapid international expansion challenged Forever 21’s single supply chain and the styles failed to resonate over time across other continents despite its initial success,” he said.

In its bankruptcy announcement, the company said it planned to close up to 350 stores.

Simon Property Group and Brookfield Property Partners are two of the company’s biggest landlords, reported CNBC, with Simon malls alone housing nearly 100 Forever 21 stores.

The report noted that Simon and fellow mall owner General Growth Properties, now owned by Brookfield, employed a similar strategy of buying tenant businesses headed for bankruptcy in 2016 when they were part of a group that won the auction to keep retailer Aeropostale out of bankruptcy court.

Simon’s malls housed 160 Aeropostale stores while General Growth Properties had 77.

In court, Forever 21 requested approval to name the potential buyers above in a “stalking horse” bid, which occurs when a bankrupt company chooses a bidder to make the first bid in order to set a minimum.

Licensing company Authentic Brands Group also took part in a stalking horse bid for Barneys New York, buying its assets alongside investment bank B. Riley Financial Inc.

Interested parties can submit their bids until Feb. 7 and, if there are bids, an auction will be held Feb. 10.

The retailer is moving quickly, seeking approval of the sale by Feb. 11.

The Latest

Sponsored by the Las Vegas Antique Jewelry & Watch Show

The Patek Philippe expert will serve as personal curator for the brand-focused company.

With Ho Brothers, you can unlock your brand's true potential and offer customers the personalized jewelry experiences they desire.

The 553-square-foot shop is aboard the Carnival Jubilee cruise ship.

NDC filed a complaint against Skydiamond for use of phrases like “diamonds made entirely from the sky.”

John Carter received the AGS’s highest honor Tuesday afternoon at Conclave in Austin, Texas.

For over 30 years, JA has advocated for the industry, fought against harmful legislation and backed measures that help jewelry businesses.

LVMH said the company performed well despite an uncertain geopolitical and economic environment.

It’s ultra-feminine and filled with gold, pearls, and soft pastels.

Its updated book for mountings is also now available.

She has been with the organization since 2010, most recently serving as its chief officer of PR and industry relations.

Joyce’s Jewelry sued the bank after cybercriminals drained its accounts of nearly $1.6 million through a series of wire transfers.

He is remembered by loved ones for his loyalty, integrity, and kindness.

Hosted by Freeman’s | Hindman, the sale will take place May 7-8.

The auction house said all 24 timepieces offered in its underground sale of rare and avant-garde watches quickly found buyers.

From lab-grown diamonds and AI to the inevitable Taylor Swift mention, here are some of Conclave’s most intriguing educational offerings.

From cybersecurity liability to trade show coverage, insurance experts share tips on how to build the right policy.

The charm is a modern rendition of the evil eye amulet that has been worn for thousands of years.

Ahead of its trade show next month, TJS awarded free registration and accommodations to one jewelry professional and three students.

By the end of this year, SRK’s diamond manufacturing complexes will achieve net zero emissions, one of an impressive array of achievements.

Members can still sell lab-grown stones, it said, but only natural gems are allowed on the show floor.

He is remembered for his charisma, passion, integrity, kindness, and wit.

The retailer also appointed two new board members, avoiding a proxy fight from a potential buyer.

The bridal collection consists of 35 engagement rings and seven wedding bands.

The crown introduced a dozen timepieces in Geneva, including a heavy metal version of its deep-sea divers’ watch.

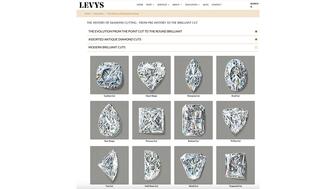

The family-owned jeweler has a new education section on its website dedicated to the history of diamond cutting.