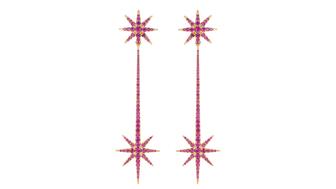

The new pink sapphire version of the piece dances with its wearer in the brand’s “Icons After Dark” holiday campaign.

Neiman Marcus Exits Bankruptcy Under New Owners

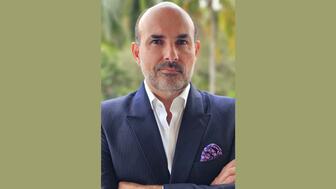

Geoffroy van Raemdonck will remain CEO of the retailer.

Dallas—Neiman Marcus has emerged from Chapter 11 bankruptcy after completing its restructuring process and reducing its debt.

The retailer has new owners, including investment firms PIMCO, Davidson Kempner Capital Management, and Sixth Street.

The new owners will finance a $750 million exit financing package, which will give the retailer additional liquidity and allow it to refinance its debtor-in-possession financing.

Neiman Marcus also received a $900 million asset-based loan from Bank of America and other commercial banks.

On top of these, it will get a $125 million FILO facility, a type of asset-based revolving credit facility, from private credit investment manager Pathlight.

The funds will be used to support ongoing operations.

The department store chain filed for Chapter 11 bankruptcy protection in May with plans to reorganize and emerge by the fall.

It had been struggling under a mountain of debt followed by disruptions related to the coronavirus pandemic, including temporary store closures and the furloughing of 14,000 employees.

The retailer has closed seven of its 43 Neiman Marcus locations and 17 of its 22 Last Call discount stores.

The most notable closure was its Hudson Yards location, a 188,000-square-foot store in the new and upscale New York City shopping center.

As per its restructuring plan, the company eliminated more than $4 billion of existing debt and more than $200 million of interest expense, with no near-term maturities.

Geoffroy van Raemdonck will remain CEO of the company and has a seat on its new board of directors.

The board also includes Meka Millstone-Shroff, a strategic operating officer at several companies; Pauline Brown, former chairman of North America for LVMH; Pamela Edwards, former chief financial officer of the Victoria’s Secret divisions of L Brands; Kris Miller, former chief strategy officer for eBay; and Scott Vogel, the managing member at investment firm Vogel Partners LLC.

“At the conclusion of this process, I remain profoundly impressed by the strength of Neiman Marcus and Bergdorf Goodman, the commitment of our associates, the unwavering support of our brand partners, and the loyalty of our customers,” said van Raemdonck in a press release.

“While the unprecedented business disruption caused by COVID-19 has presented many challenges, it has also given us the opportunity to reimagine our platform and improve our business. We emerge from Chapter 11 as a stronger, more innovative retailer, brand partner and employer."

The Latest

A choice that’s generated a lot of commentary, Pantone says “Cloud Dancer” marks a fresh start and encourages relaxation and creativity.

The man was charged with theft, accused of ingesting the necklace while in a jewelry store in Auckland, New Zealand.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

The Florida independent expanded its store from 8,000 to 14,000 square feet, fulfilling the vision of its late co-founder, Jim Dunn.

Sponsored by De Beers Group

The classic 5600 series G-Shock has been scaled down to about a tenth of its size, becoming a fully functioning watch ring.

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

The association’s annual conference and gala will take place Feb. 4, 2026, during the Tucson gem shows.

The January show will include a workshop for jewelry retailers on implementing AI to strengthen their businesses.

Fellow musician Maxx Morando proposed to the star with a chunky, cushion-cut diamond ring designed by Jacquie Aiche.

The retailer, which sells billions in fine jewelry and watches, is suing the Trump administration and U.S. Customs and Border Patrol.

Black Friday is still the most popular shopping day over the five-day holiday weekend, as per the National Retail Federation’s survey.

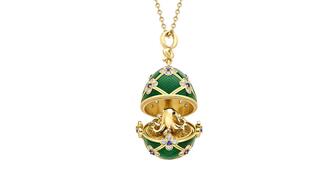

The historic egg, crafted for Russia's ruling family prior to the revolution, was the star of Christie’s recent auction of works by Fabergé.

The retailer offered more fashion jewelry priced under $1,000, including lab-grown diamond and men’s jewelry.

The eau de parfum is held in a fluted glass bottle that mirrors the decor of the brand’s atelier, and its cap is a nod to its “Sloan” ring.

Vivek Gadodia and Juan Kemp, who’ve been serving as interim co-CEOs since February, will continue to lead the diamond mining company.

Witt’s Jewelry in Wayne, Nebraska, is the organization’s new milestone member.

Laurs is the editor-in-chief of Gem-A’s The Journal of Gemmology and an expert on the formation of colored gemstone deposits.

The man, who has a criminal history, is suspected of being the fourth member of the four-man crew that carried out the heist.

The single-owner collection includes one of the largest offerings of Verdura jewels ever to appear at auction, said Christie’s.

Michael Helfer has taken the reins, bringing together two historic Chicago jewelry names.

The guide features all-new platinum designs for the holiday season by brands like Harwell Godfrey, Ritani, and Suna.

During its Q3 call, CEO Efraim Grinberg discussed the deal to lower tariffs on Swiss-made watches, watch market trends, and more.

Rosior’s high jewelry cocktail ring with orange sapphires and green diamonds is the perfect Thanksgiving accessory.

The “Embrace Your True Colors” campaign features jewels with a vibrant color palette and poetry by Grammy-nominated artist Aja Monet.

Luxury veteran Alejandro Cuellar has stepped into the role at the Italian fine jewelry brand.