Pandora’s 2021 Sales Strong as Gen Z Answers Its Call

The company’s Gen-Z-focused “Pandora Me” collection put on a particularly strong performance.

Fourth-quarter revenue was up 14 percent year-over-year to 9.01 billion Danish kroner ($1.38 billion) compared with 7.8 billion kroner ($1.2 billion) in the fourth quarter last year.

It reported organic growth of 10 percent compared with 2020 and 15 percent compared with 2019.

Its sell-out growth (sales in Pandora-owned and -operated stores) was 11 percent.

Full-year revenue was up 23 percent to 23.4 billion Danish kroner ($3.59 billion) compared with 19 billion kroner ($2.93 billion) in the previous period.

It reported organic growth of 23 percent compared with 2020 and 9 percent compared with 2019.

Its sell-out growth for the year was 20 percent.

CEO Alexander Lacik celebrated the company’s “record-breaking revenue and sell-out” in the fourth quarter.

“Our investments in digital are clearly paying off, ‘Moments’ is showing solid growth, and we are encouraged by the new product platforms ‘Pandora Me’ and ‘Brilliance.’ With this—and with network expansion accelerating in 2022—I am confident that we have all the ingredients to deliver sustainable and profitable revenue growth in the years to come,” said Lacik in a press release.

Pandora has been bolstering its digital capabilities in recent quarters, introducing a “click-and-collect” program—its buy online, pick up in store service—and driving online traffic via email marketing and platforms like TikTok and Twitch.

The company has also been working to appeal to a younger audience, particularly Gen Z as well as Millennial consumers.

To celebrate the relaunch of the “Pandora Me” collection, the company announced the “Pandora Me Collective,” which includes Gen Z influencers like Addison Rae, Donte Colley, Beabadoobee, and Cecilia Cantaran.

Singer/songwriter Charli XCX, the only millennial in the group, is also part of the collective.

The collection performed well with its intended audience, accounting for 4 percent of total revenue in the fourth quarter.

Pandora broke down its sales into “global business units,” or collections, this quarter rather than its usual product categories.

The “Pandora Me” collection saw revenue surge 169 percent for the quarter and increase 68 percent for the full year.

“Pandora Moments,” which includes its iconic charm bracelets, saw sales up 18 percent in the quarter and 26 percent for the full year.

Its “Collabs” collection, meaning collaborations, saw sales down 15 percent for the quarter and up less than 1 percent for the full year.

Its “Pandora Brilliance” collection, which includes its lab-grown diamond jewelry, was tested in the U.K to a positive reception and the company plans to roll it out this year.

Its quarterly sales were 20 million Danish kroner ($3.07 million) while full-year sales totaled 48 million Danish kroner ($7.38 million).

By sales channel, Pandora-owned retail stores, including the online store, brought in 6.47 billion Danish kroner ($994.3 million) in the fourth quarter, up 17 percent from the previous year.

For the full year, retail sales were up 19 percent year-over-year to 15.92 billion Danish kroner ($2.45 billion).

Wholesale sales in the fourth quarter were up 7 percent to 2.29 billion Danish kroner ($352 million). For the full year, wholesale sales rose 35 percent to 6.7 billion Danish kroner ($1.03 billion)

The company operated 2,619 stores as of the fourth quarter, 71 fewer when compared with the previous fourth quarter.

Pandora said it expects to open 50 to 100 concept stores in 2022.

Online sales in the quarter slipped 3 percent to 2.47 billion Danish kroner ($378.8 million), which Pandora attributed to fewer physical stores being open in 2020. Ecommerce sales accounted for 27 percent of total revenue.

For the full year, online sales were up 9 percent to 5.98 billion Danish kroner ($918.4 million), accounting for 26 percent of revenue.

The U.S. remained Pandora’s largest market, accounting for 28 percent of total revenue compared with 25 percent last year.

Quarterly revenue in the U.S. totaled 2.52 billion Danish kroner ($387.7 million), up 27 percent year-over-year.

For the full year, U.S. revenue surged 56 percent to 7.03 billion Danish kroner ($1.08 billion).

“The performance in U.S. vs 2019 is temporarily supported by the stimulus packages and a potential reallocation of consumer spend away from travel and entertainment into discretionary goods,” said Pandora.

The company said it sees “ample opportunity” for long-term growth but added 2022 is subject to uncertainty due to this year’s strong performance.

Though U.S. sales were strong in the fourth quarter, Pandora noted its long-term goal is to double its U.S. business when compared with 2019 levels.

The company’s performance in China in the fourth quarter continued to suffer the effects of COVID-19, but Pandora maintained there are still growth opportunities there.

Though physical stores were open, COVID-19 restrictions led to a decline in traffic. Online sales couldn’t offset the drop in in-store traffic.

Its key markets in Europe, including Germany and Italy, delivered positive growth with sales in Australia gradually recovered, said Pandora.

Looking ahead, Pandora expects organic growth between 3 to 6 percent in 2022 with an EBIT margin of 25 to 25.5 percent.

Pandora did not give straightforward revenue guidance as that will depend on factors like how the U.S. market performs and the COVID-19 pandemic.

The company said it assumes the U.S. jewelry market will decline 10 to 20 percent following the strong growth seen in 2021.

The company reaffirmed its target of a 5 to 7 percent compound annual growth rate from 2021 to 2023 and has raised its revenue forecast for 2023 to 27 billion to 28.1 billion Danish kroner ($4.15 billion to $4.32 billion) from 24.8 billion to 26.2 billion Danish kroner ($3.81 billion to $4.03 billion).

The Latest

From tech platforms to candy companies, here’s how some of the highest-ranking brands earned their spot on the list.

The “Khol” ring, our Piece of the Week, transforms the traditional Indian Khol drum into playful jewelry through hand-carved lapis.

The catalog includes more than 100 styles of stock, pre-printed, and custom tags and labels, as well as bar code technology products.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

The chocolatier is bringing back its chocolate-inspired locket, offering sets of two to celebrate “perfect pairs.”

The top lot of the year was a 1930s Cartier tiara owned by Nancy, Viscountess Astor, which sold for $1.2 million in London last summer.

Any gemstones on Stuller.com that were sourced by an AGTA vendor member will now bear the association’s logo.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The Swiss watchmaker has brought its latest immersive boutique to Atlanta, a city it described as “an epicenter of music and storytelling.”

The new addition will feature finished jewelry created using “consciously sourced” gemstones.

In his new column, Smith advises playing to your successor's strengths and resisting the urge to become a backseat driver.

The index fell to its lowest level since May 2014 amid concerns about the present and the future.

The new store in Aspen, Colorado, takes inspiration from a stately library for its intimate yet elevated interior design.

The collection marks the first time GemFair’s artisanal diamonds will be brought directly to consumers.

The initial charts are for blue, teal, and green material, each grouped into three charts categorized as good, fine, and extra fine.

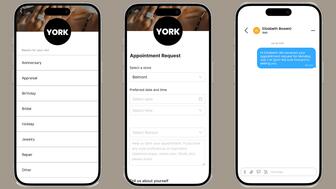

The new tool can assign the appropriate associate based on the client or appointment type and automate personalized text message follow-ups.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Endiama and Sodiam will contribute money to the marketing of natural diamonds as new members of the Natural Diamond Council.

The retailer operates more than 450 boutiques across 45 states, according to its website.

The new members’ skills span communications, business development, advocacy, and industry leadership.

The jeweler’s 2026 Valentine’s Day campaign, “Celebrating Love Stories Since 1837,” includes a short firm starring actress Adria Arjona.

The new features include interactive flashcards and scenario-based roleplay with AI tools.

Family-owned jewelry and watch retailer Deutsch & Deutsch has stores in El Paso, Laredo, McAllen, and Victoria.

The Italian luxury company purchased the nearly 200-year-old Swiss watch brand from Richemont.

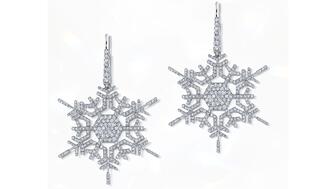

Micro-set with hundreds of diamonds, these snowflake earrings recreate “winter’s most elegant silhouette,” and are our Piece of the Week.

Ella Blum was appointed to the newly created role.

Sponsored by RapNet