In its annual report, Pinterest noted an increase in searches for brooches, heirloom jewelry, and ‘80s luxury.

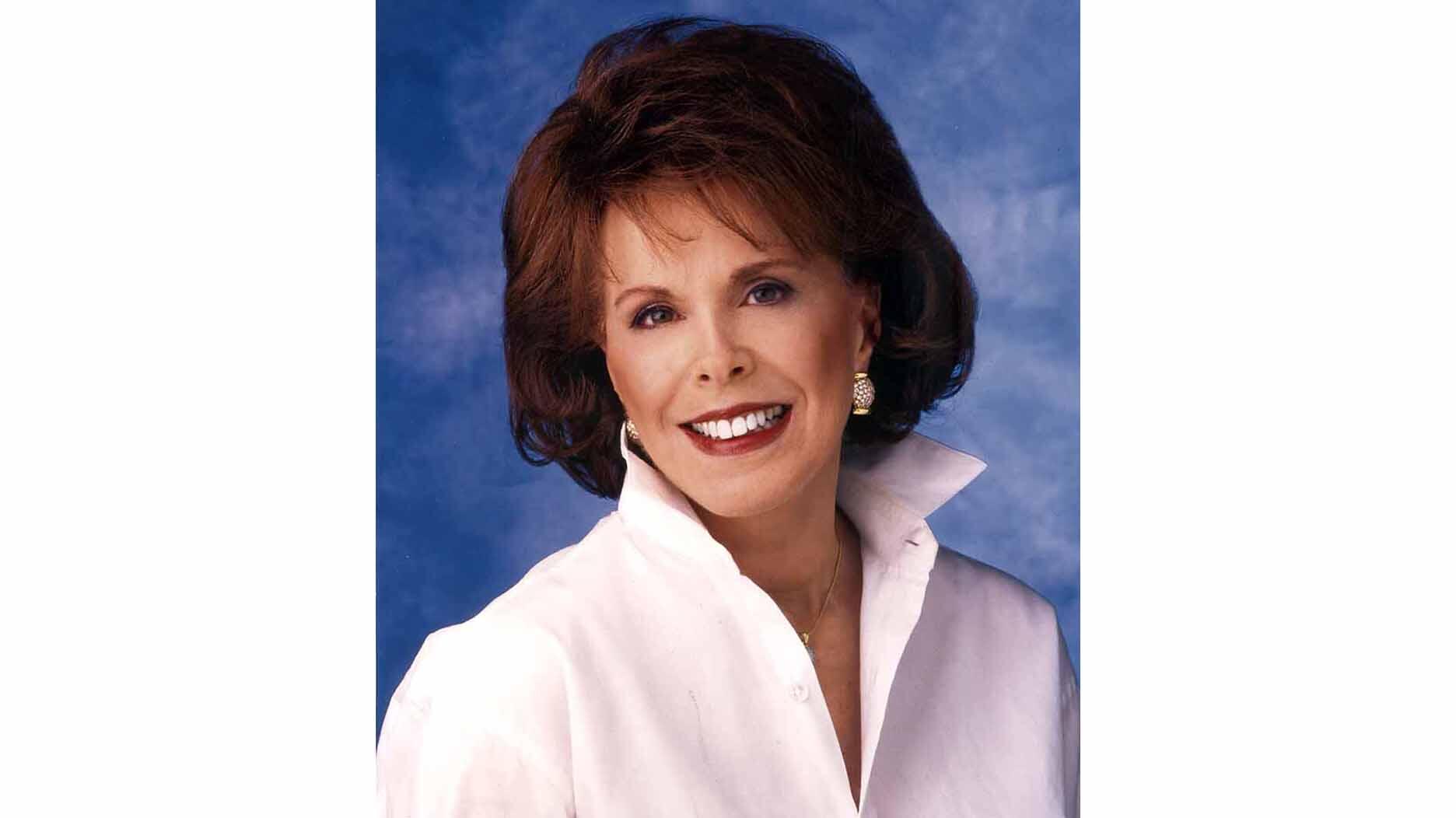

Dennis Ulrich to Retire from Richline This Year

He’s stepping down after almost 11 years and will be succeeded by Richline President Dave Meleski.

New York--Dennis Ulrich is retiring as CEO of the Richline Group after almost 11 years in the position and 45 in the jewelry industry, the company announced Thursday.

Richline’s current president, Dave Meleski, will take over as CEO, with Ulrich staying on for “some time” to assist Meleski in the transition.

Ulrich started in the jewelry business in 1974 when he began working at the “original Richline” with his father, Mitchel, and his mother, Ruth.

In 1994, Ulrich and his wife, Liz, started Bel-Oro International, focusing at first on Italian jewelry, but over time growing the company to become the largest importer of gold jewelry from Italy, Israel, Turkey and other locations around the world.

Bel-Oro and Aurafin, which was headed by Meleski, were both purchased by Warren Buffett’s holding company, Berkshire Hathaway, in 2007 and merged to form the Richline Group.

Ulrich became the CEO of Richline, with Meleski as the president.

Under the leadership of Ulrich and with Berkshire Hathaway’s backing, Richline has expanded from primarily gold jewelry into pearls, diamonds and colored gemstones, while also adding units that manufacture tools, findings and raw materials.

The company has acquired custom jewelry website Gemvara, home sales jewelry company Silpada, manufacturer The Aaron Group and pearl company Honora, among many others, over the past decade and now has more than 3,000 employees worldwide.

In a letter to employees and friends shared by Richline, Ulrich wrote: “It has been a wonderful 45 years for me in the jewelry industry, sharing all the experiences with my wife, Liz, both my kids and all my associates. I am leaving Richline in the very capable hands of Dave Meleski … I am confident his leadership will bring Richline to many new and exciting successes in the future.”

The Latest

Starting Jan. 1, customers can request the service for opal, peridot, and demantoid garnet.

The 111-year-old retailer celebrated the opening of its new location in Salem, New Hampshire, which is its third store in the state.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

The filmmaker’s personal F.P. Journe “FFC” prototype was the star of Phillips’ recent record-setting watch auction in New York.

The new location in the Design District pays homage to Miami’s Art Deco heritage and its connection to the ocean.

Inflations, tariffs, and politics—including the government shutdown—were among consumers’ top concerns last month.

Roseco’s 704-page catalog showcases new lab-grown diamonds, findings, tools & more—available in print or interactive digital editions.

“Longtime favorite” presenters, as well as first-time speakers, will lead talks and workshops at the annual event in Tucson next year.

Silas Smith of Meridian Metalworks won the challenge with his pendant that blends Australian and American landscapes.

The sale of the 31.68-carat, sunset-hued stone was part of Sotheby’s first series of events and auctions in Abu Dhabi.

Most customers who walk into your store this month have made up their minds. Your job is to validate their choice, Emmanuel Raheb writes.

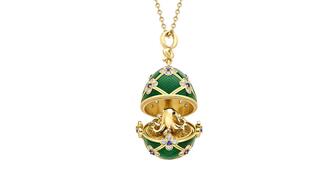

The collection features characters and motifs from Ukrainian folklore, including an enchanted mirror and a magic egg.

MatrixGold 3.11, the newest version of the jewelry design program, offers more flexibility, precision, and creative control.

The pavilion will be part of the 2026 JA New York Spring show, scheduled for March 15 to 17.

Billed as the world’s smallest wearable, Lumia Health’s new smart earrings have a health tracker subtly embedded in the back.

Don’t let those with December birthdays feel blue. Help them celebrate their month with blue zircon, turquoise, and tanzanite.

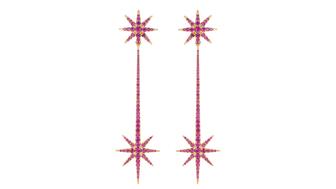

The new pink sapphire version of the piece dances with its wearer in the brand’s “Icons After Dark” holiday campaign.

A choice that’s generated a lot of commentary, Pantone says “Cloud Dancer” marks a fresh start and encourages relaxation and creativity.

The manufacturer’s holiday campaign features a gift guide filled with trending designs and jewelry that can be personalized.

The man was charged with theft, accused of ingesting the necklace while in a jewelry store in Auckland, New Zealand.

The Florida independent expanded its store from 8,000 to 14,000 square feet, fulfilling the vision of its late co-founder, Jim Dunn.

Sponsored by De Beers Group

The classic 5600 series G-Shock has been scaled down to about a tenth of its size, becoming a fully functioning watch ring.

The association’s annual conference and gala will take place Feb. 4, 2026, during the Tucson gem shows.

The January show will include a workshop for jewelry retailers on implementing AI to strengthen their businesses.

Fellow musician Maxx Morando proposed to the star with a chunky, cushion-cut diamond ring designed by Jacquie Aiche.