The 9.51-carat fancy vivid blue diamond, which set two world auction records at Sotheby’s in 2014, is estimated to fetch up to $30 million.

De Beers class action drawing to a close

The last of the checks in the De Beers class-action lawsuit settlement should go out in the next couple of weeks, and the case--which began more than 10 years ago and initially was settled in 2008--should be closed by year’s end.

New York--The last of the checks in the De Beers class-action lawsuit settlement should go out in the next couple of weeks, and the case--which began more than 10 years ago and initially was settled in 2008--should be closed by year’s end.

Earlier this week, news spread that the checks to consumers, who are part of the suit’s indirect class, had begun arriving in the mail. The minimum threshold for receiving a check is $10, meaning that anybody’s claim that amounts to less than that won’t get any money.

New York-based attorney Jared Stamell said the next round of checks set for distribution are those going to members of the direct class, those that bought gem-quality rough and polished diamonds from De Beers, its auction arm formerly known as Diamdel or any of its mining competitors between Sept. 20, 1997 and March 31, 2006.

The first round of checks for direct purchasers should be mailed in the next couple of weeks, as soon as they are able to “fill in some blanks” on a few of the claims, he said. Because they bought directly from De Beers, this class will receive a proportionately greater sum of money, with some of the payouts amounting to more than $1 million.

Stamell said that there are two large claims outstanding that they are working to resolve that may take them back to court.

If they are resolved, it will mean a second round of checks for members of the direct class. They’ll get paid in two steps, just as the retailers and manufacturers that are part of the indirect class did earlier this year.

Either way, he said he expects the case as a whole will wrap up by the end of 2013. “We’re getting close, at least on my end,” he said.

The direct purchasers first filed suit against De Beers in 2000, alleging the diamond miner and marketer acted in a monopolistic manner in order to control diamond prices. Retailers, manufacturers and consumers followed with lawsuits in 2004 and 2005.

In May 2008, De Beers and the plaintiffs reached a $295 million settlement, with De Beers admitting no fault in the case.

The company, once banned from doing business in the United States because of anti-trust issues, since has launched Forevermark here, and its executives now visit regularly. CEO Philippe Mellier attended the recently concluded JCK show,

Since the settlement, however, appeals have had the case hung up in court and delayed any payouts.

"I am disappointed in the sense that the way objectors are handled in class-action (cases) that it got delayed for years,” Stamell said when asked about the conclusion of the case. “I would have preferred to see this money go out during the recession when people really needed it. If all things had gone properly the money would have been out five years ago.”

The Latest

The industry veteran joins the auction house as it looks to solidify its footprint in the jewelry market.

The nonprofit awarded four students pursuing a professional career in jewelry making and design with $2,250 each.

With their unmatched services and low fees, reDollar.com is challenging some big names in the online consignment world.

The Texas-based jeweler has also undergone a brand refresh, debuting a new website and logo.

The two organizations have finalized and signed the affiliation agreement announced in May.

The single-owner sale will headline Sotheby's inaugural jewelry auction at the Breuer building, its new global headquarters, this December.

Jewelers of America is leading the charge to protect the industry amidst rising economic threats.

From sunrise yoga to tariffs talks, these are some events to check out at the upcoming inaugural event.

Smith recalls a bit of wisdom the industry leader, who died last week, shared at a diamond conference years ago.

The “Victoria” necklace features a labradorite hugged by diamond accents in 18-karat yellow gold.

Two lower courts have moved to block the import taxes, which will remain in place as the legal battle continues.

The Kansas City Chiefs quarterback shares Hublot’s dedication to pursuing greatness, the Swiss watchmaker said.

Breitling is now the NFL’s official timepiece partner, a move that puts the brand in front of the millions of Americans who watch football.

NYCJAOS is set for Nov. 21-23 in New York City’s Chelsea neighborhood.

U.S.-based investment company SMG Capital LLC is the new owner of the luxury brand.

A new court filing details the locations of the stores that will close, as well as the 830 that will remain open.

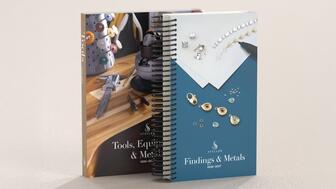

The new catalogs are “Tools, Equipment, & Metals” and “Findings & Metals.”

Sapphire’s variety of colors make it the perfect birthstone for September.

The retailer has raised its guidance after seeing total sales increase 3 percent in the second quarter, beating expectations.

Niccolò Rossi di Montelera, executive chairman of the board, was appointed as interim CEO.

The three-floor space also features the jeweler’s largest VIP salon in Japan and offers an exclusive diamond pendant.

The collection is a collaboration between Stephanie Gottlieb Fine Jewelry and Oak and Luna, focusing on understated essentials.

The highlight of a single-owner jewelry and watch collection, it’s estimated to fetch up to $7 million at auction this December.

CEO Efraim Grinberg noted a resurgence in the fashion watch market.

The “Bullseye” necklace, with vintage bakelite and peridot, August’s birthstone, is the perfect transitional piece as summer turns to fall.