He retired last month after 28 years traveling the world to source the very best gemstones for his family’s jewelry business, Oscar Heyman.

De Beers, Diacore Buy Blues From the Cullinan Mine

The two companies paid a little over $40 million for the five diamonds, which range in size from 10 to 26 carats.

London—De Beers Group and Diacore are partnering to buy the five blue diamonds recovered from South Africa’s Cullinan Mine in the same week earlier this year.

De Beers and the diamond manufacturer are paying $40.36 million, split equally between the two companies, for the collection, which totals 85.62 carats and ranges in size from about 10 to 26 carats.

Two natural color diamond experts, Joseph Namdar of Namdar Inc. and Eden Rachminov, said they cannot comment on the purchase price until the diamonds are polished and graded.

“I can tell you with absolute certainty, however, that the buyers are counting on the diamonds being graded as fancy vivid blue,” Namdar said. “Even if they are all graded intense blue, I don’t believe they (De Beers and Diacore) will cover their investment.”

Rachminov, chairman of the board of the Fancy Color Research Foundation, which collects and analyzes wholesale and retail data on fancy color diamonds, called the purchase of the five blue diamonds a “smart move.”

“Generally speaking, any rare fancy color diamond is considered to be a safe purchase these days as the supply diminishes year after year,” he said.

“We also see that fancy color diamond producing mines are slowly closing, such as the Argyle mine, and other mines’ futures, such as Petra (Cullinan) in South Africa and Dominion (Ekati) in Canada, are not clear.”

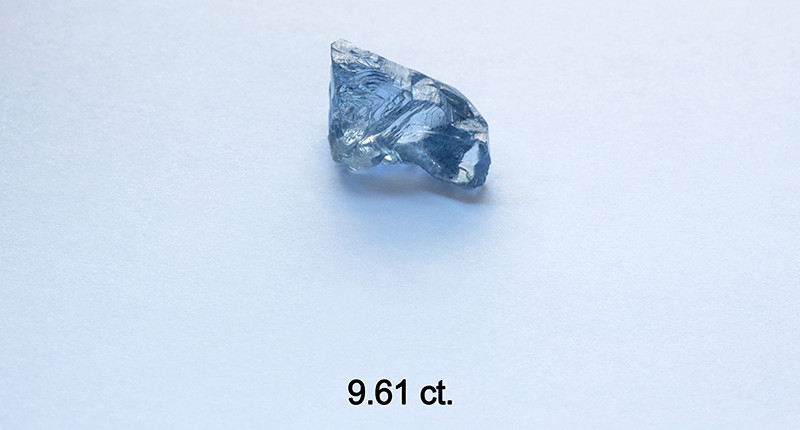

The diamonds (which can be seen below in the slideshow, in ascending order of size) are: 9.61, 11.42, 17.57, 21.25, and 25.75 carats.

De Beers and Diacore said in the news release on the purchase of the diamonds they will select

“expert craftsmen” to study and cut the diamonds.

Petra announced it was selling the five blue diamonds via tender about a month ago, immediately after the financially troubled miner handed itself over to lenders in a debt-for-equity restructuring deal.

The diamond miner is also dealing with allegations that security employees and contractors at the Williamson mine in Tanzania beat and shot at artisanal miners who trespassed on the site, killing at least seven of them. Petra owns a 75 percent stake in the mine; the government of Tanzania owns the other 25 percent.

Leigh Day, the same U.K. law firm that sued Gemfields over human rights abuses at its ruby mine in Mozambique, has filed a claim against Petra in the High Court in London on behalf of 35 Tanzanians who

The Latest

The charm necklace features six nautical charms of shells and coral that founder Christina Puchi collected on Florida’s beaches.

The organization elected its youngest vice president as it looks to draw in fresh talent.

The Seymour & Evelyn Holtzman Bench Scholarship from Jewelers of America returns for a second year.

Campbell joins the company as vice president of business development while Liebler is the new vice president of operations.

The medals feature a split-texture design highlighting the Games’ first time being hosted by two cities and the athletes’ journeys.

Sponsored by The INSTORE Jewelry Show 2025

The countdown is on for the JCK Las Vegas Show and JA is pulling out all the stops.

Globally, travel and transportation brands reigned, while in the U.S., alcoholic beverage companies and a lingerie brand took the top spots.

The Brooklyn-based jewelry designer is remembered as a true artist and a rare talent.

A new slate of Learning Workshops will take place in Oklahoma, Mississippi, and Georgia.

The middle class is changing its approach to buying jewelry and affordable luxury goods, the NRF said.

It marks the third consecutive quarter of growth for Cartier, Van Cleef & Arpels, Buccellati, and Vhernier.

The reseller’s market trends report, based on its sales data, also shows exactly how much Rolex prices have jumped since 2010.

The auction house will be hosting a retrospective paying tribute to jeweler Jean Dinh Van and his company’s 60th anniversary.

Jake Duneier and Danielle Duneier-Goldberg have stepped into the roles of CEO and president, respectively.

The “Impermanence” collection contemplates nature through the Japanese art of Ikebana (flower arranging) and philosophy of wabi-sabi.

The Texas-based jewelry retailer has set up shop in Tennessee and Arizona.

Eric Ford will step into the role, bringing with him decades of experience.

In addition to improved capabilities, the acquisition will allow the jeweler to offer support to other independent jewelers.

The “Celestial Blue” capsule collection campaign features Olympian Kateryna Sadurska.

The seasonal store, located in Mykonos, Greece, offers exclusive events, personal styling, and curated experiences.

The New England jeweler is hosting a bridal event for the month of August.

Its sessions will focus on inventory strategies, staff performance, retention and acquisition, emerging market trends, and more.

For its 10th anniversary, Miseno designed the “Arco” earrings based on the Arco Felice, an arch conceptualized in A.D. 95 in Miseno, Italy.

The jewelry company is one of several contributing to relief efforts in the region after the recent floods.

Inspired by fiancé Sid Wilson’s nickname for her, the white and yellow diamond ring features a unique honeycomb design.