These Are the Core Consumer Groups Buying Lab-Grown Diamonds

They include millennials of a certain age, women who buy jewelry for themselves, and “upgraders,” according to The MVEye.

Drawing on recent research, “The MVEye’s Core 3.5 LGD Consumer Segments” outlines the primary groups it says are driving the “explosive global growth” of the lab-grown diamond sector.

The groups identified through the research, as well as suggested communications strategies from the market research firm for each, are as follows.

Segment 1: “In the Know”

Who they are: This group is comprised of 25- to 38-year-old millennials who are already aware of lab-grown diamonds, whether it’s through friends or media. This group includes multiple ethnicities and non-traditional couples.

How retailers can reach them: The MVEye said retailers should focus on sustainability, social responsibility, and the technology behind the stones—offering them knowledge not only on the production process but also the ease of tracking them along the pipeline, co-founder Liz Chatelain said to National Jeweler.

They should also focus on what The MVEye calls the “price-to-value equation,” meaning they should point out to consumers that they can get more for their money with lab-grown diamonds.

After all, consumers are now willing to go over their initial budget to get a bigger and better diamond, Chatelain said.

Segment 2: “In the Dark”

Who they are: This group is comprised of 25- to 38-year-old millennials who haven’t heard of lab-grown diamonds but are easily convinced to learn more, the marketing firm said. This group also includes multiple ethnicities and non-traditional couples.

Chatelain said this is where retailers can have the greatest impact on customers’ buying decisions. She said it is their role to introduce these consumers to lab-grown diamonds, promote the product, and educate consumers about them.

She said retailers have told The MVEye that they introduce lab-grown as an option if the shopper wants a larger, good quality diamond that fits their budget. The conversion rate from an “assumed mine diamond shopper” to a lab-grown consumer can now be as high as 70 percent, she added.

How retailers can reach them: Focus on education and talking about the technology behind lab-grown diamonds as well as, again, the price-to-value equation.

Segment 3: “Upgraders”

Who they are: They are consumers ages 55 and older who are looking to upgrade their engagement rings. They may not already have a lot of knowledge about lab-grown diamonds, but they’re motivated to buy a larger diamond.

How retailers can reach them: This group has been marketed to the least, according to Chatelain.

But they do like to reward themselves, so communications should focus on budget, size, and how the stone is a deserved reward for the lives they have led.

“If retailers could bring that across to them [in ads], saying, ‘OK, it’s time to self-reward,’ that’s how they’re going to go get this group,” Chatelain said. “It’s a great opportunity, especially for independent retailers who really know their market.”

Segment 3.5: “SPF”

Who they are: “Self-purchasing females” of all ages.

Chatelain said they numbered SPF as 3.5 because there is crossover with the other segments.

How retailers can reach them: Chatelain said the consumer who buys for herself feels good about buying larger diamonds, a trend she believes will play out in items like stud earrings.

Based on The MVEye research, the most successful retailers are expanding into lab-grown diamond jewelry basics, like studs and solitaire pendants.

Other Key Research Findings

The MVEye said these consumers aren’t necessarily all about the digital shopping experience.

They’re interested in special experiences in-store, on social media, and on e-commerce sites, and will pay a premium for it.

For jewelry retailers, this means it’s important to track important client life events, like birthdays or anniversaries, so they can have targeted communications on these occasions and point out products clients might be interested in, making it clear they will cater to them.

“Now to the customer, it’s not about price; it’s about premium service,” she said.

And, interestingly, rather than buying products from stores, they buy from brands, The MVEye’s research found.

The idea of loyalty to a store has shifted to mean loyalty to brands within the store or because of the store’s location, Chatelain said, though she did also note their research shows shopper loyalty is greater for fine jewelers than others.

The Latest

Endiama and Sodiam will contribute money to the marketing of natural diamonds as new members of the Natural Diamond Council.

The retailer operates more than 450 boutiques across 45 states, according to its website.

The new members’ skills span communications, business development, advocacy, and industry leadership.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The jeweler’s 2026 Valentine’s Day campaign, “Celebrating Love Stories Since 1837,” includes a short firm starring actress Adria Arjona.

The new features include interactive flashcards and scenario-based roleplay with AI tools.

Family-owned jewelry and watch retailer Deutsch & Deutsch has stores in El Paso, Laredo, McAllen, and Victoria.

How Jewelers of America’s 20 Under 40 are leading to ensure a brighter future for the jewelry industry.

The Italian luxury company purchased the nearly 200-year-old Swiss watch brand from Richemont.

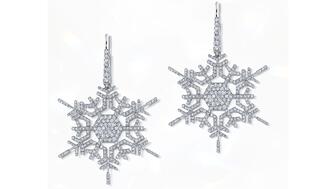

Micro-set with hundreds of diamonds, these snowflake earrings recreate “winter’s most elegant silhouette,” and are our Piece of the Week.

Ella Blum was appointed to the newly created role.

Sponsored by RapNet

Investment firm Enhanced Retail Funding, a division of Gordon Brothers, was the successful bidder.

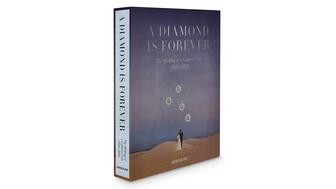

It explores the history of the iconic tagline and the company’s strategy to redefine the role of diamonds in society.

Retail veteran Sindhu Culas has stepped into the role.

Taylor Burgess, who has been at Stuller since 2013, was promoted to the newly created role.

Was 2025 a good year for jewelers? Did lab-grown diamonds outsell natural? Find out on the first episode of the “My Next Question” podcast.

Whether you recognize their jewels or are just discovering them now, these designers’ talent and vision make them ones to watch this year.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Plus, JSA’s Scott Guginsky discusses the need for jewelers to take more precautions as the gold price continues to climb.

Morris’ most cherished role was being a mother and grandmother, her family said.

“Vimini” is the first chapter of the “Bulgari Eternal” collection that merges archival pieces with modern creations.

The third edition will be held in Half Moon Bay, California, in April.

The grant is in its first year and was created to recognize an exceptional fine jewelry designer whose star is on the rise.

Data built on trust, not tracking, will be key to success going forward, as the era of “borrowed attention” ends, Emmanuel Raheb writes.

Heath Yarges brings two decades of experience to the role.

Pete’s boundless curiosity extended beyond diamond cut and he was always eager to share his knowledge with others, no matter the topic.