Holiday Sales to See Slowed Growth, Says NRF

Plus, how inflation and winter weather could impact holiday spending.

The National Retail Federation released its annual holiday sales forecast Thursday and is expecting retail sales to grow between 6 to 8 percent year-over-year to between $942.6 billion and $960.4 billion.

Last year, holiday retail sales were up nearly 14 percent year-over-year to a record-breaking $889.3 billion.

Over the past 10 years, holiday retail sales have averaged an increase of 5 percent, said the NRF, with the pandemic spending of recent years accounting for “considerable” gains.

Here are five key takeaways from the NRF’s holiday forecast.

Inflation remains a top concern for holiday shoppers.

The Federal Reserve is continuing its fight against inflation, raising interest rates six times this year, but rising prices are still weighing on consumers.

NRF CEO Matthew Shay described consumer behavior as more thoughtful and cautious during a forecast call Thursday.

“We know that lower- and middle-income consumers are feeling the most pressure when it comes to inflation,” said Shay, noting more of their income is going to housing, rent, energy, and food costs, leaving less for gifts and other holiday expenses.

These households are expected to rely more on their savings and credit to purchase holiday gifts.

In contrast, higher income households are expected to spend significantly more on average on holiday gifts, seasonal items, and other retail categories.

NRF Chief Economist Jack Kleinhenz said, “Consumers are worried about inflation. It’s on the top of their minds.”

A recent KPMG holiday survey came to the same conclusion, finding that inflation topped the list of shopper concerns, with 85 percent of those surveyed saying they were at least somewhat concerned about inflation.

“But they still have the ability to spend,” Kleinhenz added, noting consumers are supported by job growth, rising wages, and the ability to tap into savings.

The NRF defines the holiday season as Nov. 1 through Dec. 31, but the holiday season has been extending into fall for the last decade, it noted.

The early shopping trend is due in part to concerns about inflation and product availability, said Kleinhenz.

In response to inflation, 46 percent of holiday shoppers said they would be browsing or buying before November, as per the NRF’s annual survey conducted by Prosper Insights & Analytics.

“Retailers are responding to that demand, as we saw several major scheduled buying events in October,” said Kleinhenz. “While this may result in some sales being pulled forward, we expect to see continued deals and promotions throughout the remaining months.”

Consumers plan to spend $832.84 on average on gifts and holiday items, such as decorations and food, which is in line with the average for the last 10 years.

The labor market will be an ongoing challenge for retailers.

NRF expects retailers will hire between 450,000 and 600,000 seasonal workers this year, down from 669,800 seasonal hires last year.

Notably, the method used to calculate holiday retail employment in 2020 was changed to accommodate the significant impact of COVID-19 on overall industry employment, the NRF said. In 2021, it returned to a traditional employment buildup method.

Some seasonal hires may have been counted in October, said the NRF, as retailers look to bolster their teams before the holiday season.

Retailers looking to hire will have to compete, as always, with other industries, to find the best talent.

“It’s been a tight job market. We still have 800,000 job openings in retail as of the end of September,” said Kleinhenz. “It will be an ongoing challenge.”

Shay described the labor market as “a real conundrum for employers,” but noted it’s also a partial explanation for why consumers have continued to spend.

“[The labor market] is one of the reasons consumers have behaved in such a resilient way, because wages are increasing and there’s pressure on the market and that keeps people spending.”

Shay noted some retailers in need of employees have gotten creative, highlighting UPS’ plan to hire more than 100,000 seasonal workers. The company retains, on average, more than one-third as permanent employees.

Winter weather poses an unpredictable problem.

How retailers fare this holiday season may somewhat depend on where they’re located.

Warmer-than-average temperatures are expected in the Southwest, the Gulf Coast, and the Eastern Seaboard, according to the National Oceanic and Atmospheric Administration.

These sections of the country account for a large chunk of the U.S. population, noted NRF.

However, those located in the northern tier of the country are expected to see wetter and snowier weather.

Online shopping remains popular, but there may be a shift back to in-store shopping.

Online shopping will continue to grow this holiday season.

Online and other non-store sales, which are included in the total, are expected to increase between 10 and 12 percent to between $262.8 billion and $267.6 billion.

Sales in this category reached $238.9 billion last year, a significant jump as shoppers turned to e-commerce due to the pandemic.

However, the NRF said shoppers are also looking for a more traditional, in-store shopping experience.

The NRF’s holiday survey found 57 percent of respondents plan to shop online, up slightly from 56 percent last year.

The second-most popular destination was department stores (47 percent) followed by discount stores (44 percent).

As for what gifts consumers are hoping for, gift cards topped the list (54 percent), followed by clothing or accessories (49 percent) and electronics (24 percent). Jewelry was in sixth place at 21 percent, up from 20 percent in 2021 and 2020.

Overall retail sales are expected to grow between 6 and 8 percent year-over-year in 2022 to between $4.86 trillion and $4.95 trillion.

The Latest

The chocolatier is bringing back its chocolate-inspired locket, offering sets of two to celebrate “perfect pairs.”

The top lot of the year was a 1930s Cartier tiara owned by Nancy, Viscountess Astor, which sold for $1.2 million in London last summer.

Any gemstones on Stuller.com that were sourced by an AGTA vendor member will now bear the association’s logo.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

The Swiss watchmaker has brought its latest immersive boutique to Atlanta, a city it described as “an epicenter of music and storytelling.”

The new addition will feature finished jewelry created using “consciously sourced” gemstones.

In his new column, Smith advises playing to your successor's strengths and resisting the urge to become a backseat driver.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The new store in Aspen, Colorado, takes inspiration from a stately library for its intimate yet elevated interior design.

The brands’ high jewelry collections performed especially well last year despite a challenging environment.

The collection marks the first time GemFair’s artisanal diamonds will be brought directly to consumers.

The initial charts are for blue, teal, and green material, each grouped into three charts categorized as good, fine, and extra fine.

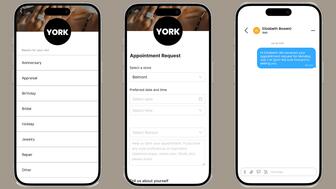

The new tool can assign the appropriate associate based on the client or appointment type and automate personalized text message follow-ups.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Endiama and Sodiam will contribute money to the marketing of natural diamonds as new members of the Natural Diamond Council.

The retailer operates more than 450 boutiques across 45 states, according to its website.

The new members’ skills span communications, business development, advocacy, and industry leadership.

The jeweler’s 2026 Valentine’s Day campaign, “Celebrating Love Stories Since 1837,” includes a short firm starring actress Adria Arjona.

The new features include interactive flashcards and scenario-based roleplay with AI tools.

Family-owned jewelry and watch retailer Deutsch & Deutsch has stores in El Paso, Laredo, McAllen, and Victoria.

The Italian luxury company purchased the nearly 200-year-old Swiss watch brand from Richemont.

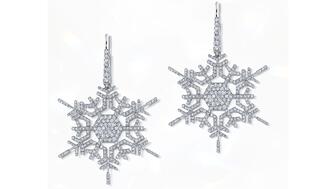

Micro-set with hundreds of diamonds, these snowflake earrings recreate “winter’s most elegant silhouette,” and are our Piece of the Week.

Ella Blum was appointed to the newly created role.

Sponsored by RapNet

Investment firm Enhanced Retail Funding, a division of Gordon Brothers, was the successful bidder.

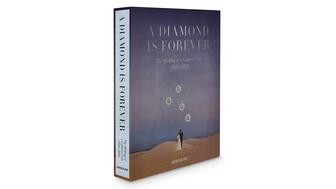

It explores the history of the iconic tagline and the company’s strategy to redefine the role of diamonds in society.

Retail veteran Sindhu Culas has stepped into the role.