Squirrel Spotting: It’s a Diamond Moment!

It’s no doubt diamond sales are booming, but why? Peter Smith explores the complicated reasons why consumers want the stones right now.

OK, full disclosure: I’m struggling to embrace the contemporary use of that particular noun, as ubiquitous as it has become of late, but if there was ever an occasion to use it, this might be it.

In the main, we have seen diamonds and diamond jewelry ascend to the fore as most retail jewelers enjoy a period of success not realized since pre-recession days. For those keeping score, we’ll call that 2007/2008.

Exactly why diamond products have become such a draw for jewelry consumers is open to debate, but the data is clear—there has been a significant shift at retail away from other products and toward diamond jewelry.

The Edge Retail Academy, a consulting and data aggregating company, reports sales of diamond products are up 40 percent for the trailing 12 months, with units showing a robust 32 percent increase.

Notwithstanding some of that trailing 12 months vs. previous 12 months data captures a couple of the early pandemic months, there can be little doubt that the importance of diamond products has increased in the past year and a half.

But why?

De Beers’ “A Diamond Is Forever” campaign signaled the ascension of diamonds as a cultural imperative in what might be one of the best examples of what psychologists call priming that we’ve ever seen.

The principle of priming is the seller of goods seeds the required behavior they seek without the customer being conscious of the subtle-but-effective messaging.

In other words, I don’t need to tell you to buy a drink at Starbucks; I just have to assault your olfactory senses with the scent of coffee and off you go.

That consistent messaging of diamonds as a cultural imperative had a profound impact that saw diamonds grow from about 10 percent of engagement rings on the eve of World War II to about 85 percent today.

Another example of priming from De Beers came in the 1980s when the company told consumers they ought to spend two months’ salary on a diamond. That primer, increased from their 1930s message of about one-month’s salary, set the expectation and framed the conversation for millions of buyers and sellers in the decades since.

Besides a collective yearning for a return to a strong and consistent campaign from De Beers, what, you may ask, does any of that have to do with the results we are seeing today with diamonds and diamond jewelry?

In short, it’s complicated.

In his piece for “Consumer Neuroscience,” Moran Cerf wrote, “The common psychological response to uncertainty is a negative state with increased chances of anxiety.”

Simply put, when consumers experience anxiety in their lives, they consciously, and unconsciously, make buying decisions that reduce anxiety, not add to it. Risky purchases exacerbate the already heightened anxiety and are avoided at all costs.

Buying diamonds and diamond jewelry brings a certain order and a promise of stability not always true of other purchases.

Whether diamonds really are “a girl’s best friend” is another cultural trope up for debate, but it is likely very rare that receiving and/or wearing diamond jewelry elicits feelings of regret or disappointment.

They are, in effect, the least risky purchase one can make in a jewelry store.

The shift towards diamond products has been a boon for retail jewelers.

While we are witnessing the first uptick in foot traffic into jewelry stores in more than a decade (only because we are currently comparing traffic to what was experienced with the onslaught of COVID-19), the trend of declining foot traffic will return and the need for a higher average ticket will be paramount for retailers to continue the positive momentum of recent months.

If retail jewelers used this period to curate their core diamond jewelry assortments to reflect the tastes of their market (hint: what sells in one market tends to sell everywhere!), if they have embraced data-sharing and fast replenishment of their core diamond products—pendants, earrings, line bracelets, diamond bands and, naturally (pun, what pun?), diamonds—they will have positioned themselves to carry that momentum into the season and beyond.

Here’s to a great holiday season!

The Latest

Sponsored by American Gem Trade Association

In its holiday report, PwC said the season will be more like jazz—improvisational and less predictable—than an easy-to-follow melody.

The jewelry giant will relocate its existing facility to a larger space in Anne Arundel.

With their unmatched services and low fees, reDollar.com is challenging some big names in the online consignment world.

The designer, who is the creative force behind her namesake brand, has now started a new mini line focusing on chains for fathers and sons.

The awards include tuition for a course at the Swiss lab, economy flights, and hotel accommodation.

The 21-day program was designed to help jewelry retailers identify opportunities and eliminate inefficiencies with AI.

Jewelers of America is leading the charge to protect the industry amidst rising economic threats.

A set of four Patek Philippe “Star Caliber 2000” pocket watches is part of Sotheby’s upcoming auction in Abu Dhabi.

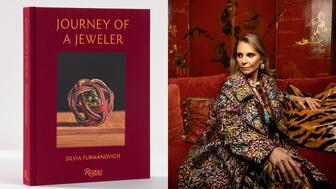

The Brazilian jeweler’s latest book marks her namesake brand’s 25th anniversary and tells the tale of her worldwide collaborations.

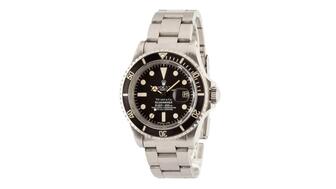

The Submariner Ref. 1680 with a Tiffany & Co. dial came from the original owner, who won it as a prize on the game show in the 1970s.

The new integration allows users to manage shipments directly from the Shopify dashboard.

At Converge 2025, Editor-in-Chief Michelle Graff attended sessions on DEI, tariffs, security, and more. Here are her top takeaways.

Six people were shot last week at an Oakland cash-for-gold shop as employees exchanged gunfire with individuals trying to rob the store.

The jeweler has expanded its high jewelry offering, which launched last year, with new pieces featuring its cube motif that debuted in 1999.

Ben Bridge Jeweler and Lux Bond & Green were a part of the pilot program.

Associate Editor Natalie Francisco shares eight of her favorite jewelry looks from the 77th annual Primetime Emmy Awards, held Sunday night.

It’s predicting a rise in retail sales this holiday season despite economic uncertainty and elevated inflation.

It included the sale of the 11,685-carat “Imboo” emerald that was recently discovered at Kagem.

The newly elected directors will officially take office in February 2026 and will be introduced at the organization’s membership meeting.

Associate Editor Lauren McLemore headed out West for a visit to Potentate Mining’s operation hosted by gemstone wholesaler Parlé Gems.

Fordite is a man-made material created from the layers of dried enamel paint that dripped onto the floors of automotive factories.

Gilbertson has worked as a researcher, jeweler, lapidary artist, appraiser, and business owner throughout his decades in the industry.

A decision likely won’t come until January 2026 at the earliest, and the tariffs remain in effect until then.

Located in the revamped jewelry hall at the retailer’s New York City flagship, this opening is Tabayer’s first shop-in-shop.

The new, free app offers accessible educational content, like games and podcasts, for U.S. retailers.

As the gold price rises, the manufacturer is offering a 100 percent payout through Sept. 30 for gold clean scrap.