Guthrie, the mother of “Today” show host Savannah Guthrie, was abducted just as the Tucson gem shows were starting.

Q3 Gold Jewelry Demand Slips 3% in US

But the market was relatively resilient compared with the rest of the world, where demand remains 'in the doldrums,' the WGC says.

London—The COVID-19 pandemic continues to have a negative effect, unsurprisingly, on gold jewelry demand.

According to the World Gold Council’s Gold Demand Trends report for Q3, demand lifted from its record low in the second half, but was still “in the doldrums,” hampered by the global economy and high gold prices.

According to Kitco, gold peaked at $2,067.15 per ounce in August before slowing down, averaging a per-ounce price of $1,900.27 in October. It started the year at $1,560.67 per ounce (average) in January.

Global jewelry demand was at 333 tons in the third quarter, registering its third-lowest quarterly total in WGC’s data going back to Q1 2001 and representing a 29 percent decrease over the same period last year.

Comparing in value terms is “less stark,” WGC said, noting Q3 jewelry demand was at $20.4 billion, only an 8 percent decrease year-over-year.

The lift it did have over the second quarter was due to most markets seeing at least some relaxation in the strictest lockdown measures, according to the report, with some also seeing a notable shift toward online shopping.

Meanwhile, gold jewelry demand year-to-date totaled just 904 tons, the lowest in the council’s data series “by some margin”—it’s a 30 percent decease compared with the same period in 2009, when demand was 1,292 tons.

WGC said though China and India were major contributors to the global weakness because of their significance to the market, weakness was universal, with “no bright spots of note.”

The U.S., however, proved to be “relatively resilient” compared with global markets, posting a small decline of 3 percent year-over-year in the third quarter.

In-store demand was still “anemic” in the third quarter as consumers avoided shops and malls; online sales picked up a lot of that loss, WGC added.

Meanwhile, as China returned to a more normal state post-lockdown in the third quarter, jewelry demand continued its recovery from Q1 lows but stayed very soft compared with the same period in 2019.

The region’s gold jewelry demand was 119.1 tons in Q3, representing a 31 percent rebound from Q2. And though it marked a 25 percent year-over-year decline, the gold council said it was still much smaller than the 52 percent drop in H1 demand.

RELATED CONTENT: Gold Passes $2K Per Ounce as Jewelry Demand Plummets

Year-to-date demand in China hit 271 tons, a 43 percent decrease over the first nine months of 2019.

Gold jewelry demand in the region was 48 percent lower year-over-year at 52.8 tons, which WGC said was the third-lowest quarter for Indian jewelry demand in its data series.

Consumers there not only were coping with recurring lockdowns and their heavy economic impact as well as unprecedented gold prices, but also the timing of two Hindu celebrations in September being considered inauspicious for gold buying.

Demand was also weak in Turkey and across the Middle East as well as in Europe, where gold demand decreased 17 percent compared with the year-earlier period. But Europe’s Q3 results also meant a 32 percent quarterly improvement, reflecting a release in pent-up demand as lockdowns eased.

Demand for gold overall dropped to 892.3 tons in the third quarter—its lowest quarterly total since Q3 2009—as the global pandemic continued to effect consumers and investors alike.

At 2,972.1 tons, year-to-date demand is 10 percent below the same period of 2019.

Supply was also down in Q3, declining by 3 percent year-over-year to 1,224 tons.

Mine production also decreased by 3 percent to 884 tons as the industry continue to suffer from COVID-19 restrictions, though the World Gold Council noted it still marks a substantial recovery over Q2.

Year-to-date, total supply was down 5 percent over the same period in 2019 due to disruption from the pandemic.

The Latest

Butterfield Jewelers in Albuquerque, New Mexico, is preparing to close as members of the Butterfield family head into retirement.

Paul Morelli’s “Rosebud” necklace, our Piece of the Week, uses 18-karat rose, green, and white gold to turn the symbol of love into jewelry.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

It is believed the 24-karat heart-shaped enameled pendant was made for an event marking the betrothal of Princess Mary in 1518.

The AGTA Spectrum and Cutting Edge “Buyer’s Choice” award winners were announced at the Spectrum Awards Gala last week.

The “Kering Generation Award x Jewelry” returns for its second year with “Second Chance, First Choice” as its theme.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

Sourced by For Future Reference Vintage, the yellow gold ring has a round center stone surrounded by step-cut sapphires.

The clothing and accessories chain announced last month it would be closing all of its stores.

The “Zales x Sweethearts” collection features three mystery heart charms engraved with classic sayings seen on the Valentine’s Day candies.

The event will include panel discussions, hands-on demonstrations of new digital manufacturing tools, and a jewelry design contest.

Registration is now open for The Jewelry Symposium, set to take place in Detroit from May 16-19.

Namibia has formally signed the Luanda Accord, while two key industry organizations pledged to join the Natural Diamond Council.

Lady Gaga, Cardi B, and Karol G also went with diamond jewelry for Bad Bunny’s Super Bowl halftime show honoring Puerto Rico.

Jewelry is expected to be the No. 1 gift this year in terms of dollars spent.

As star brand Gucci continues to struggle, the luxury titan plans to announce a new roadmap to return to growth.

The new category asks entrants for “exceptional” interpretations of the supplier’s 2026 color of the year, which is “Signature Red.”

The White House issued an official statement on the deal, which will eliminate tariffs on loose natural diamonds and gemstones from India.

Entries for the jewelry design competition will be accepted through March 20.

The Ohio jeweler’s new layout features a curated collection of brand boutiques to promote storytelling and host in-store events.

From heart motifs to pink pearls, Valentine’s Day is filled with jewelry imbued with love.

Prosecutors say the man attended arts and craft fairs claiming he was a third-generation jeweler who was a member of the Pueblo tribe.

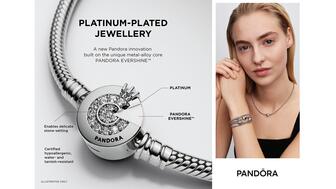

New CEO Berta de Pablos-Barbier shared her priorities for the Danish jewelry company this year as part of its fourth-quarter results.

Our Piece of the Week picks are these bespoke rings the “Wuthering Heights” stars have been spotted wearing during the film’s press tour.

The introduction of platinum plating will reduce its reliance on silver amid volatile price swings, said Pandora.

It would be the third impairment charge in three years on De Beers Group, which continues to grapple with a “challenging” diamond market.