5 Things Retailers Should Know About the Start to the Holiday Season

Plus, what a potential rail strike would mean for retailers.

Despite inflationary pressures, shoppers turned out in droves to take advantage of holiday weekend deals.

However, a looming rail strike could spell big trouble for the rest of the holiday season.

Here are five key takeaways from the NRF survey.

A record number of consumers shopped over the holiday weekend.

During the five-day period from Thanksgiving Day through Cyber Monday, a record 196.7 million Americans shopped in stores and online, up 9 percent compared with 179.8 million shoppers last year.

It marks the highest number of shoppers for this period since the NRF first started tracking this metric in 2017.

More than three-quarters (76 percent) of consumers surveyed said they shopped over the holiday weekend compared with 70 percent in 2021.

The number of shoppers exceeded the NRF’s initial expectations by more than 30 million.

Consumers spent an average of $325.44 on holiday-related purchases over the weekend, up from $301.27 in 2021.

“It is important to note that while some may claim that retail sales gains are the result of higher prices, they must acknowledge the historic growth in consumers who are shopping in-store and online during the long Thanksgiving holiday weekend and into Cyber Monday. It is consumer demand that is driving growth,” said NRF CEO Matthew Shay.

Black Friday is still king of the shopping days.

Black Friday was the most popular day for both in-store and online shopping.

On Black Friday, 72.9 million consumers shopped in stores, up 10 percent compared with 66.5 million in 2021.

Though Cyber Monday is meant to promote online shopping, Black Friday also was the most popular day for online shoppers, continuing a trend that began in 2019.

Around 87.2 million consumers shopped online on Black Friday, in line with 2021 stats.

The Saturday after Thanksgiving, dubbed Small Business Saturday, was the second most popular day for in-store shopping, with 63.4 million in-store shoppers, up 25 percent from 51 million last year.

A majority (77 percent) of Saturday shoppers said they shopped specifically to support small businesses.

On Cyber Monday, 77 million people shopped online, similar to last year’s numbers. Notably, a record 59 percent of Monday shoppers used their mobile device, up from 52 percent last year.

In-store shopping is back and early shopping is here to stay.

Retailers welcomed more consumers in-store this year.

Over the holiday weekend, more than 122.7 million people shopped in brick-and-mortar stores, up 17 percent compared with 2021.

“It was very obvious this year that there was an enormous resurgence of in-store shopping,” said Shay on a media call Tuesday.

“That reflects the enthusiasm for the weekend, for being out and resuming some of those pre-pandemic behaviors, reliving and renewing some of the family traditions, and being out publicly in ways we haven’t been able to in several years.”

Online shopping saw more moderate growth, up 2 percent year-over-year with 130.2 million consumers buying online.

The top destinations for shoppers were online (42 percent), department stores (42 percent), grocery stores and supermarkets (40 percent), clothing and accessories stores (36 percent) and discount stores (32 percent).

The top gifts purchased were clothing and accessories (50 percent), toys (31 percent), gift cards (27 percent), books/video games/other media (24 percent), food and candy (23 percent) and electronics (23 percent).

As for when people went shopping, more than half (56 percent) of respondents said they shopped holiday sales before Thanksgiving.

One-quarter shopped before Nov. 16 while more than one-third (36 percent) were shopping in the week leading up to Thanksgiving (Nov. 16-23).

A rail strike could be disastrous for the holiday season.

The looming threat of a freight railroad strike could lead to a walk-out of more than 100,000 union members.

“Any slowdown, stoppage, or delay in rail transit of goods and people in this country would be devastating for our economy, for American households, and for working families,” said Shay, adding he hopes Congress can move quickly to resolve the situation.

The NRF relaunched a grassroots campaign this week, calling on Congress to pass legislation to avoid a strike.

Rail workers are asking for paid sick leave, which they are not currently given, and for changes to be made to an attendance policy that penalizes workers for taking time off when sick, according to The Washington Post.

Rail workers and the railroads have been in talks to negotiate a deal that would avoid a shutdown for months, but the Dec. 9 strike deadline is approaching.

On Monday, President Biden and other Democratic leaders called on Congress to impose a deal, one voted down by union members, that would avoid a shutdown.

“As a proud pro-labor President, I am reluctant to override the ratification procedures and the views of those who voted against the agreement,” Biden said in a statement.

“But in this case—where the economic impact of a shutdown would hurt millions of other working people and families—I believe Congress must use its powers to adopt this deal.”

Though many retailers have their holiday inventory on hand already, the impact of a rail strike would still be significant.

“Our concern is not only the direct impact on retail, but the broader impact on other sectors of the economy that would impact employment, consumer spending, confidence levels, all of those things. We think the holiday season would be the worst possible time,” said Shay.

The holiday outlook remains the same.

Despite myriad economic headwinds and the potential rail strike, the NRF’s holiday forecast remains the same.

It expects retail sales to grow 6 to 8 percent year-over-year to between $942.6 billion and $960.4 billion.

“It continues to be an unpredictable year and very different from the last two holiday seasons,” said Shay, citing headwinds like inflation, interest rates, and a tight labor market.

However, consumers are still spending. Retail sales have grown year-over-year every month since May 2020, marking 30 consecutive months of growth after a brief contraction at the start of the pandemic.

And there’s still more shopping to come.

Though holiday shopping has been starting earlier in recent years, many people save their major holiday shopping for November and December.

“On average, consumers say they are almost halfway (47 percent) done with their holiday shopping at this point in time, leaving plenty of room for additional purchases in the remaining weeks of the year,” said Prosper Executive Vice President of Strategy Phil Rist.

The Thanksgiving weekend turnout left Shay hopeful for the remainder of the holiday season.

“The only r-word we need to worry about is the railway strike, not the other one [recession] because what we’re seeing here doesn’t seem to reflect any sense of negativism about economic prospects.”

NRF defines the holiday season as Nov. 1 through Dec. 31.

The survey was conducted from Nov. 23-27 and reached out to 3,326 adult consumers.

The Latest

IGI is buying the colored gemstone grading laboratory through IGI USA, and AGL will continue to operate as its own brand.

The Texas jeweler said its team is “incredibly resilient” and thanked its community for showing support.

From cool-toned metal to ring stacks, Associate Editor Natalie Francisco highlights the jewelry trends she spotted at the Grammy Awards.

Launched in 2023, the program will help the passing of knowledge between generations and alleviate the shortage of bench jewelers.

The medals feature a split-texture design highlighting the fact that the 2026 Olympics are taking place in two different cities.

The “Khol” ring, our Piece of the Week, transforms the traditional Indian Khol drum into playful jewelry through hand-carved lapis.

The catalog includes more than 100 styles of stock, pre-printed, and custom tags and labels, as well as bar code technology products.

Criminals are using cell jammers to disable alarms, but new technology like JamAlert™ can stop them.

The chocolatier is bringing back its chocolate-inspired locket, offering sets of two to celebrate “perfect pairs.”

The top lot of the year was a 1930s Cartier tiara owned by Nancy, Viscountess Astor, which sold for $1.2 million in London last summer.

Any gemstones on Stuller.com that were sourced by an AGTA vendor member will now bear the association’s logo.

The Swiss watchmaker has brought its latest immersive boutique to Atlanta, a city it described as “an epicenter of music and storytelling.”

The new addition will feature finished jewelry created using “consciously sourced” gemstones.

In his new column, Smith advises playing to your successor's strengths and resisting the urge to become a backseat driver.

The new store in Aspen, Colorado, takes inspiration from a stately library for its intimate yet elevated interior design.

The brands’ high jewelry collections performed especially well last year despite a challenging environment.

The collection marks the first time GemFair’s artisanal diamonds will be brought directly to consumers.

The initial charts are for blue, teal, and green material, each grouped into three charts categorized as good, fine, and extra fine.

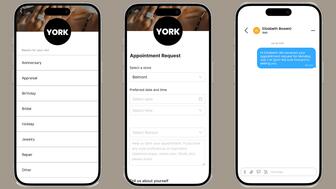

The new tool can assign the appropriate associate based on the client or appointment type and automate personalized text message follow-ups.

Buyers are expected to gravitate toward gemstones that have a little something special, just like last year.

Endiama and Sodiam will contribute money to the marketing of natural diamonds as new members of the Natural Diamond Council.

The retailer operates more than 450 boutiques across 45 states, according to its website.

The new members’ skills span communications, business development, advocacy, and industry leadership.

The jeweler’s 2026 Valentine’s Day campaign, “Celebrating Love Stories Since 1837,” includes a short firm starring actress Adria Arjona.

The new features include interactive flashcards and scenario-based roleplay with AI tools.

Family-owned jewelry and watch retailer Deutsch & Deutsch has stores in El Paso, Laredo, McAllen, and Victoria.

The Italian luxury company purchased the nearly 200-year-old Swiss watch brand from Richemont.